With all the headlines lately, it’s easy to wonder what all the calamity is about. When you look under the hood at the fundamentals, the earnings reporting season has actually been quite strong. According to FactSet, 76% of companies have beaten earnings-per-share (EPS) estimates and 73% have surpassed revenue expectations.

Despite these strong numbers, the market is clearly working through a transition. We are seeing a distinct style rotation away from Growth and toward Value. This is best illustrated by the Dow Jones Industrial Average recently breaking 50,000, while the Nasdaq has faced a difficult few weeks — particularly software stocks that have seen their role in the AI trend called into question.

The AI Infrastructure Reality Check

Is the AI bubble finally exhaling? There is certainly a high level of speculation occurring in areas like gold, silver and cryptocurrency. Furthermore, commodities appear to be reacting to significant geopolitical tensions, reflecting fears of conflict in Iran, nuclear rhetoric from Russia or continued pressure from China.

However, Wall Street often “climbs a wall of worry,” and this current environment seems to be another classic example. Our partners at NASDAQ Dorsey Wright have offered a compelling perspective: the “New Economy” is currently tethered to the “Old Economy.”

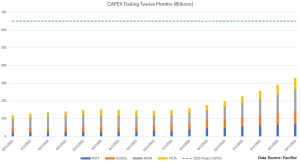

While the initial phase of the AI boom focused on software and semiconductors, investors are now waking up to the massive infrastructure requirements needed to scale these technologies. The financial reality of building out data centers and energy networks is staggering:

- Microsoft, Alphabet, Amazon and Meta are projected to invest over $600 billion combined into AI in 2026.

- This level of spending is expensive and reduces the financial flexibility of these tech giants.

- The reliance on high cash flows for share buybacks is being tested as companies spend heavily to meet forward AI expectations.

A Shift in Market Leadership

This massive capital flow is moving from “New Economy” tech sectors into “Old Economy” sectors like energy, industrials and basic materials.

We can see this shift clearly in the performance data:

- The Leaders: Energy (XLE), Industrials (XLI) and Basic Materials (XLB) have all gained more than 10% year-to-date, with Energy leading the pack at nearly 20%.

- The Laggards: Financials (XLF), communication services (XLC), technology (XLK) and consumer cyclical (XLY) are the only four sectors down this year, though none are down more than 3%.

These shifts have triggered notable changes in the DALI (Dynamic Asset Level Investing) rankings. Energy entered the year ranked ninth but has gained 58 signals to move into fourth place. Meanwhile, technology saw the sharpest decline of any sector, falling from the top spot down to fifth. While AI technology remains the “spearhead,” the buildout required to support it is revitalizing the “Old Economy” in a way we haven’t seen in decades.

The Road Ahead: The Presidential Cycle

Looking at the broader historical context, the presidential cycle is also worth considering. While 2026 is technically “Year Two” of the current term, Jeffrey Hirsch of the Stock Trader’s Almanac refers to it as “Year 6” because this is the Trump administration’s second term.

History shows that Year 6 typically follows a specific pattern:

- A February sell-off followed by a few months of gains.

- Increased volatility over a 3-4 month period as the Midterm elections approach.

- A powerful move following the Midterm low through the end of the next year.

In fact, history shows positive returns 80% of the time during this phase, with average gains ranging from 40% to 60%.

The Bottom Line: our “Roaring 2020s” thesis remains intact. While this isn’t individual investment advice, we encourage you to think twice before discarding core holdings. Instead, consider the benefits of rotating into the sectors that are currently showing the strongest leadership.