Younger investors may not realize that Corning (NYSE: GLW) has long been at the forefront of materials science innovation. With a history rich in creating glass and ceramics that transform industries, Corning is now making significant strides with optical components, primarily driven by the burgeoning field of Artificial Intelligence (AI). *Note: we hold GLW shares for clients at Granite Wealth Management.

The Role of AI in Corning’s Growth

As investors continue to search for ways to play AI, which relies heavily on data transmission and high-speed connectivity, many of them look for ways to take a “picks and shovels” approach to finding winners in the space, a strategy that has fueled demand for Nvidia (NVDA), for example, which has fueled its meteoric rise over the past year.

As industries incorporate AI into daily operations, the demand for advanced optical components that can handle increased data flow and improve connectivity is skyrocketing. Could Corning, with its expertise in specialty glass and optical physics, be uniquely positioned to help meet these demands?

Enhanced Optical Components

Corning’s optical components, which include fiber optic cables and connectors, are essential for the infrastructure required by AI technologies. These components ensure faster, more reliable data transmission—a must for the efficient functioning of AI systems, which process vast amounts of data in real time and in parallel.

Innovation in Fiber Optic Technology

Corning’s innovations in fiber optic technology, such as their ClearCurve® and SMF-28® Ultra fiber products, provide enhanced bandwidth and transmission capabilities. These advancements are critical in supporting the data-heavy tasks performed by AI, from machine learning algorithms to neural networks.

Corning’s Springboard Plan for Growth

Recognizing the potential of AI, Corning has strategically positioned itself through its Springboard Plan for Growth, which focuses on leveraging core technologies and expanding their applications in AI-driven markets.

Part of the Springboard Plan includes forming strategic partnerships and considering acquisitions that align with Corning’s core competencies in materials science. By integrating AI into their research and development processes, Corning aims to stay ahead of technological advancements and anticipate the needs of the AI market.

Investment in R&D

Corning is also ramping up its investment in research and development, particularly in areas that intersect with AI applications. This not only includes optical components but also extends to new materials and technologies that can further enhance AI functionalities.

Investment Timing?

The fundamentals a lot of sense and the company is clearly in the early stages of a growth ramp. That said, many companies have compelling stories. This stock has already woken up and started to rally, no doubt due to the recognition of its AI story… what do the technicals say about the Corning’s prospects today?

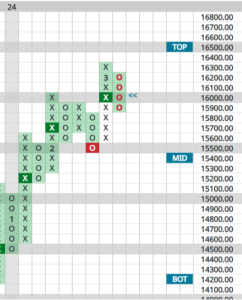

Yesterday’s powerful breakout will challenge the April 2021 high:

After years of sideways action, this breakout is significant, with a potential Price Objective in the high $70’s.

If that price target seems aggressive, investors should take a look at a long-term chart of this “old school” company. Many forget it was one of the many story stocks of the late ’90’s internet era, and that the all-time high is will above $100.

I guess what we’re saying is that it appears GLW is taking off as a story stock yet again. That said, the recent straight-line move from October’s bottom does leave the stock very extended. Consider initiating or adding to positions closer to the break out point of in the $36- 38 range — if you get the chance.