How a company the size of Alphabet (GOOGL), Google’s parent company, can still grow earnings by 20%, and revenues by nearly as much, is a remarkable achievement.

Still, threats are everywhere. In the antitrust trial about Google’s potentially monopolistic behavior in dominating search, we’re all awaiting a decision that is likely to come this month. And that’s not the only current antitrust risk Alphabet faces; the remedy phase of the advertising case, in which the company has already been ruled a monopolist, begins in September.

All of these legal battles will likely take years to fully resolve. Still, these cases have almost certainly been a fundamental overhang on the stock. By the way, it’s not just Alphabet with a lot at stake in this ruling.

Meanwhile, AI threats are everywhere. Late last year, Elon broke the “coherence bottleneck,” a challenge that all of Silicon Valley had struggled with up to that point. It’s an amazing story. ChatGPT has such an enormous first-mover advantage that despite being passed in performance, its user numbers may already be impossible for any company to catch. And hundreds of billions of dollars continue to flow to AI investments of all kinds.

The weight of this competition is causing Alphabet to increase its already enormous capex budget, which gives some fundamental Wall Street analysts heartburn.

A lot to worry about, to be sure.

So, as we always ask: what does the chart say about all this?

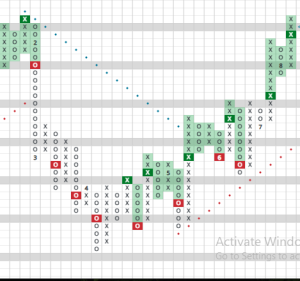

GOOGL recently matched its chart high print $204 seen on 1/25/2025:

Now, the question is: can it punch through to an all-time high and reach its Point & Figure charting price objective of $242?

Ordinarily, I would lean toward a clear ‘yes’ in response to that queston but current conditions warrant a little short-term caution.

First, due to the sharp rally from the April lows as marked by the ‘4’ in the chart (remember, numbers are months in P&F charts), GOOGL already resides at the top of its expected short-term trading band.

In addition, the traditionally “scary” stock market months of September and October loom. A lot traditional stock market occurences (like “Sell in May and go away”) have been busted in recent years, but this seasonality does still often provide significant headwinds. My gut suspects that a pullback toward the mid point of its trading band near $180 is a strong possibility. Thus, at this particular moment, the stock feels like a hold — by no means would we suggest getting cute and trying to sell GOOGL here in hopes of picking it back up on a small drawdown. Too clever by half.

You noticed I referred to my gut in the paragraph above. It’s not gut so much as experience, and that experience does go beyond strictly trading on charts alone. Do I lean on the analytic approach to analyzing supply and demand that’s furnished through Point & Figure charting? Yes.

But man does not live by charts alone and even a technical analyst like me has to factor in fundamental concepts.

It’s what helped fuel our decision to hold NVDA through its recent drawdown (it remains our biggest single holding on behalf of clients), which was based on our bigger picture economic thesis. Our ability to stay bullish since the October 2022 low, in fact, admittedly mixes in some “art” of fundamental analysis.

But still, we start with charts.

Back to GOOGL: could it buck the looming seasonal trend and push higher? Indeed. If a significant breakout occurs soon, we will udpate our view, with all new targets, stops, etc.

What fundamental developments might drive a push higher? Well, AI is not merely a threat, but a driver of Google’s future, as well. No company has more data on which to train its models, which is why Gemini has become a force since its flawed launch. And Alphabet’s ability to invest is virtually unmatched. Add in the clearing of these upcoming antitrust dates, regardless how the rulings shake out, should remove some of the near-term uncertainty which markets hate most.

In Alphabet’s case, the fundamentals are tricky enough at the moment, they argue for not factoring them in too heavily today. In this case, the chart prevails. By no means is GOOGL a sell in our view. Rather, viewing it as a hold and being prepared for some volatility in coming weeks seems the prudent move.

If it outperforms today’s cautious view, no shareholder is going to be disappointed.

**August 2025 Note to Readers:

We here at Granite Wealth have seen a surge in new client accounts over the past 6 weeks. I mention it because it’s unusual; typically, we see a surge after big market drawdowns, when investors are unhappy with their advisors, who they learn often have no plan in such situations. Most brokers focus only on what to buy, not so much the “when” part of investing.

Recent conversations are making clear to us that some investors realize we have seen such extraordinary gains since April that it’s time to assess their positioning and to prioritize protection of their gains. This is refreshing because I have seldom seen such a mindset in the euphoric afterglow of a raging bull rally. Again, it’s more likely after pain.

If you would like a chart-based viewpoint on your portfolio holdings, don’t be shy. Reach out and we’ll gladly provide a rundown. Maybe we’ll end up working together, maybe we won’t, but I suspect you’ll find this free checkup very unusual and refreshing.