Yesterday’s CPI print continues to portray a picture of moderating inflation and increasing calls for the Federal Reserve to pause, perhaps as early as next month’s meeting.

Such a backdrop should be great for higher gold prices, correct? We doubt there’s much near-term upside from here, but first some level-setting.

With the rally since the fall of last year from $1650 to over $2000 today, gold bugs are back in vogue. Keep in mind, however, they’ve enjoyed almost no returns since gold peaked near $1825 almost 12 years ago:

Indeed, gold is down over that period in inflation-adjusted terms — the gold bug’s favorite kind of terms, no?

For a simple contrast, here’s a look at the S&P’s 250% increase since gold’s last major peak in August of 2011:

Since we all know past performance doesn’t guarantee future results, perhaps it is time for gold to take the lead?

Precious metals bulls say this backdrop is the perfect scenario to launch gold out of its 10 year trading range. Looking at a 15-year Point & Figure chart (our primary method of technical analysis), we also see an August 2020 breakout above the highs seen in 2011.

Is this eclipsing of the 15-year resistance significant? Gold bugs would say it definitely is; we say ‘perhaps.’

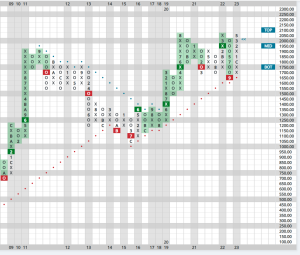

For starters, one can see by looking at the top/mid/bottom band at the upper/right of the following chart that gold currently resides at the top of its expected near-term range. Given the high price of this asset, we use $50 box sizes to calm the noise and help paint for us a clear picture:

Further, the current rising column of X’s in the chart above current tests a level gold has failed to breach twice since 2019 by our style of analysis.

Should gold run further and break above $2100, we would be impressed and perhaps gain more respect for the metal’s recent strength, but even then we would advise waiting for pullbacks due to short-term overbought conditions.

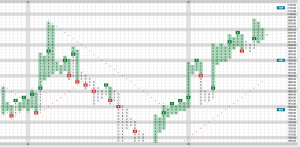

On a shorter-term view and even with smaller, $20 box sizes, the importance of that 2100 level can be seen here

So how should traders approach gold today?

In our view, buyers should be patient. They can either wait for a much more important break above $2100, then a pullback.

Or — more likely in our view — those who don’t yet own any of the yellow metal can be patient and wait for a pullback to the lower end of the current band.

Yes, the idea that gold will again be available for purchase around the $1700 level is an unpopular view at the moment.

That’s why we like it.

Gold is an underweight currently.