Today is election day, and that always comes paired with unrelenting news platforms blasting forecasts and results in your face for days leading up to the election, and weeks afterwards as well. What also comes along with midterm elections, though, is the historical trend of positive stock market returns in the 12 months following midterm elections.

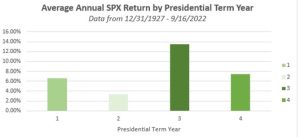

Going back to 1946, the S&P 500 boasts positive 12-month returns following midterm elections – 19 out of 19 times! While past results are not a guarantee of future returns, there’s something to be said of historical trends. Further, the third year of a presidential term has historically been, far and away, the best year for returns:

There’s a few reasons that stock market returns tend to turn positive after usually-flat periods leading up to midterm elections:

- The President’s party tends to lose seats in Congress at midterms, which can ease DC gridlock, politically speaking

- The expectation that a new Congress will increase government spending

- The political agendas become more clear and discernable, particularly to those that they affect the most (businesses, for example)

- Businesses, as a result, can plan and forecast with less unknowns in the planning process

While it’s clear what history has shown us, there are other considerations worthy of mention. Inflation, for one, is very high, and “an additional infusion of funds seems unlikely this year, given the government’s historic levels of spending and stimulus in response to the pandemic,” says Schwab’s Chief Investment Officer, Liz Ann Sonders – more spending could worsen the inflationary outlook. The war in Ukraine (and how deeply the US remains involved), and associated relations with Russia are both hot-button topics.

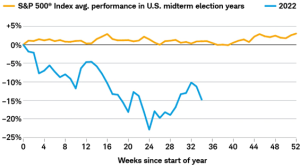

On a simpler level, the S&P 500 hasn’t acted as it normally does in an election year either. While election years typically see mundane returns that tend to be flat, we’ve seen majorly negative moves since January of this year.

From our lens, we assess that the 12 months ahead will align fairly closely with the historic levels of positive growth in the stock market, while bonds could likely follow with a little lag time, given that it will take time for the Fed to ease its policy after this tightening periods comes to a close over the next 6-8 weeks. We do recognize the differences in this midterm year compared to those of the past, though we are confident that the markets remain poised to put a stronger foot forward with more political clarity in the coming weeks.

.