After weeks of hand wringing over valuations in technology stocks broadly, the market is giving us a day of pullbacks in some of the biggest names following last week’s earnings reports.

Investors know, however, that we are early in what is typically a very favorable 5 or 6 month period for stocks. For those looking to do some buying during this traditionally bullish season, here are some ideas for how to approach timing.

First, I suggest pausing for 60 seconds to read this background article on trading bands, which I will refer to as we assess two familiar stocks: Meta (META) and Microsoft (MSFT).

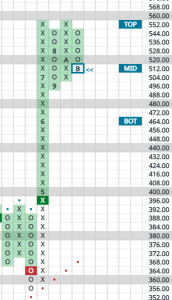

Microsoft:

Here, we’ve seen a nice 10% pullback since earnings posted just last week:

As you can see, the stock has already moved from arguably overbought back to the middle of its expected trading band. It is not a value yet and I would not argue there’s a rush to enter but interested traders could perhaps start nibbling. Because there has been limited backing and filling in this area, it would be hard to come up with a stop loss, except for a double-bottom break if the declining column of O’s fell to 488, so we don’t have one to recommend at this point.

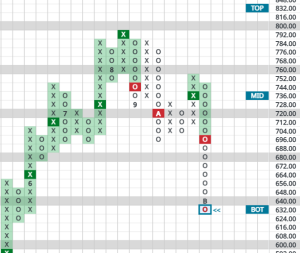

Meta:

This pullback started a few weeks earlier but has been more extreme (20%):

Because it has moved all the way to the bottom of its expected trading band already, we would expect downside pain from here to be muted from here, even if tech names continue to sell off for a few days. It is again very tricky to set a clear stop so traders should make their own plan when entering a name like this and stick to it.

As always, this article is for informational purposes only and is not investment advice. Please conduct your own research and consider your personal risk appetite before investing.

That said, anyone interested in doing some buying based on the favorable calendar is not crazy. And enough damage is already being done in some names to think opportunities may present themselves soon.