Would You Play Piano with Only One Hand?

Unemotional. Objective. Data-Driven.

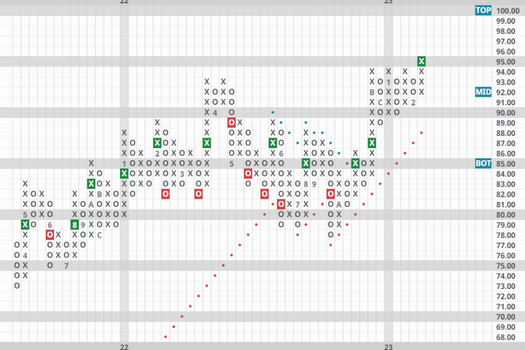

Ever heard the phrase, he “fell in love” with that stock? Inexperienced investors get caught up too deeply into a company’s story alone. We let the clear picture of price action — supply and demand — lead our thinking.

Industry outlook, company cash flows, etc. These and other metrics of fundamental analysis are certainly worth analyzing, but they only tell half the story.

Supply and demand is what drives the price of all goods and services; why would things be any different in the stock market?

Always on Duty

We Love Helping You Win

“I wish I had found Granite Wealth earlier! The last 8 years with them have been great”

-Sandro Pero, Big Pine Key, Florida

Aggressive Growth? Conservative Income?

Move beyond cookie-cutter asset allocations

Your Stage Matters (meaning, stage of life)

Younger investors in accumulation mode should welcome bear markets.

Older investors in wealth preservation mode must steer clear of them, and we can create a sustainable distribution plan sensibly using your accumulated capital.

Everyone in between needs their own nuanced plan that resides between the two.

In today’s markets, doesn’t the experience of a 40-year professional sound like the kind of guidance you might need?