Can raising a puppy have lessons for your money? Oh, it might be a stretch to suggest so, but I’m so enamored with our incredible dog that I hope you’ll indulge me as I make that case.

First, a bit about our pup, Bahzil. We picked him up at a farm in Maine on a snowy April morning 4 years ago, brought him to his new home and sat him on the back steps. He is a tricolor Australian Shepard we named 2 years prior to his arrival, after the common male English surname Basil. ‘What a cool name for a dog,’ we thought.

Over these 4 years, definitive traits have emerged in him. He is loyal, smart and curious, affectionate and highly trainable. These are his best attributes.

Are there parallels for your money in these attributes?

Loyalty

Bahzil is the ultimate guard dog of our property, always on duty at the gate vetting who’s coming and going. I came across a brilliant line that catches him to the tee.

“My house. My yard. My humans. Don’t even try it!” Like I said, always on duty.

Early in my career, I was a loyal quant. PE, PEG ratios, book value was my thing. I would never buy an internet stock, good heavens! Then in the 1990’s I came across Point and Figure chart-based analysis, primarily following the daily missives at the time from Dorsey Wright.

I had always been in awe by chart luminaries such as Stan Weinstein of the Professional Tape Reader and Marty Zwieg’s work. After the usual learning curve of 10,000 hours, Point and Figure analysis was ingrained in me and I was able to unleash its powerful tools. 35 years later, I remain loyal to it.

I like to say that at Granite Wealth, we play the piano with both hands – we value both fundamental and technical analysis. That said, the indisputable law of supply and demand has an uncanny ability for the technical hand to foreshadow the fundamental hand. When you find an investment methodology that works for you, honor it and be loyal to it.

Affection

Have affection for spending your money on things that enhance the quality of your family’s life. Money is not meant to be admired from afar in a bank or investment account statement. Yes, we all have financial goals as we look to secure our families’ financial security, maybe even for future generations if we do it well.

But what about you? Haven’t you been the one to save and invest all these years?

We all want to make life more comfortable for our kids and grandkids and it’s rewarding to see them in an environment where they are set up to thrive as we pay for education and help finance first homes. Leaving money wisely through inheritance after our days are gone is tricky. Maybe Buffet’s answer to leaving little to his kids is not the answer, but it should be somewhere in between.

The Value of a Routine

A training regimen is very important as dogs seek routine, predictability and consistency. The approach to your investment methodology encompasses these as well.

Routine should be part of your data analysis. However, be open to challenging your biases.

Allow for some flexibility in your rules-based decisions. As many of our readers know, our primary analysis comes from technical databases as we feel the charts gives us insight into what the fundamentals are doing. Further, relative strength and trendlines play an Important part when we seek top performing sectors and induvial holdings.

Let me give you a recent real-time example. It’s Nvidia NVDA, which we have written quite a bit about.

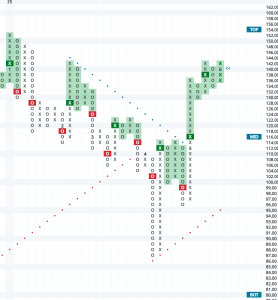

Immediately following liberation day, the stock sold off hard. In fact, it almost got cut in half: $150 to $87.

At the time, we felt confident that this was simply a flight to the safety of value investment names and nothing else. Growth, and particularly technology, had been market leaders for years and we felt that the shift to value would be temporary.

This view was not without some angst, however, as NVDA plummeted. It violated the bullish support line at $108 and its relative strength retreated from parabolic readings of the last few years.

How should we have reacted to this? Instead of blind adherence to chart patterns, we leaned here on the experience that comes with nearly 4 decades of market experience. Our gut feeling was that growth investments and technology stocks would soon reassert themselves and that we should ignore the knee jerk reactions even though some of the chart signals along the way were typically quite important in our rules-based decisions.

Right on cue with the passing of Trump 2.0 and the first 100 days, the stock made an important upside break at $116, around the mid-point of its trading band. When earnings arrived, NVDA reached its February high of $142.

From here, an important additional upside breakout would be at $144 and the technical price objective would then suggest $217.

If we strictly adhered to our rules and sold at the bullish support line breakdown and the waning relative strength, today we would feel worse than swallowing the temporary down draft from $152 to $87.

Having a routine and being disciplined in one’s approach to investing does not mean being inflexible.

When Bahzil doesn’t get his walk at the time he expects each day, when the time does arrive he’s more than happy to head out a little later than expected.

With Nvidia, we had to let that stock act like a dog for a while. It took us on a short, vigorous and uncomfortable walk, but one we are glad today that we stuck with despite the fact that staying the course meant straying a bit from our technical routine.

In retrospect, I think Bahzil would approve.