As we settle into 2026, one narrative has dominated the headlines and, more importantly, the supply chains of the technology sector: the unrelenting shortage of memory chips. For over a month now, we have watched a tightening in the semiconductor market that shows absolutely no sign of letting up. If anything, the data suggests we are in the early innings of a structural shift: a “supercycle” that will define the investment landscape for the remainder of the year.

***Did you know we have created a 20-page whitepaper outlining the entire AI investment landscape? Click here to claim your free copy!

For the average consumer, this shortage is beginning to feel like a crisis. We are seeing immediate price pressure on smartphones, laptops and consumer electronics. The headlines from Bloomberg, Fast Company and others are not exaggerating when they warn of soaring hardware prices. When the cost of the raw components – specifically DRAM and NAND flash – spikes by 50% in a quarter, manufacturers like Apple and Dell have two choices: compress their margins or pass the pain to the consumer. Currently, they are doing a bit of both.

But as investors, our job is not to lament the rising cost of a new iPhone; it is to understand the market structure and position capital where the “relative strength” lies. And technically speaking, the strength right now is squarely with the producers.

The AI Factor: A Permanent Shift in Demand

This is not a traditional cyclical shortage caused by a factory fire or a logistics snag. This is a demand-shock driven by the voracious appetite of Artificial Intelligence. The buildout of AI infrastructure – data centers, training clusters and edge inference devices – requires massive amounts of High Bandwidth Memory (HBM).

The “Big Three” memory makers – Samsung, SK Hynix and Micron – have effectively sold out their capacity for high-end chips well into 2027. We’ve even seen Micron make the strategic pivot to exit low-margin consumer lines to focus entirely on enterprise and AI-grade memory. When supply is fixed and demand is exponential, price is the only release valve.

The Investment Thesis: Follow the Capex

From a technical analysis perspective, we are seeing a classic rotation. While hardware stocks may struggle with headwinds from component costs, the memory manufacturers are enjoying immense pricing power. However, the opportunity extends beyond just the chipmakers. To fix this shortage, the industry must expand capacity. This creates a bullish setup for the “picks and shovels” of the ecosystem – specifically in data storage and infrastructure.

We are currently watching two names in this sector closely that illustrate different technical setups:

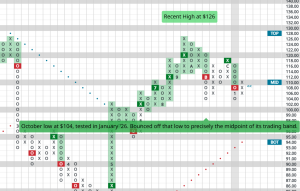

NetApp (NTAP) remains in a solid positive trend. We have seen a constructive pullback over the last three months, which, in the context of a primary uptrend, often signals a lower-risk entry point. The stock has tested support at the mid-range of its expected trading band and looks poised to resume its leadership role as data center spending accelerates.

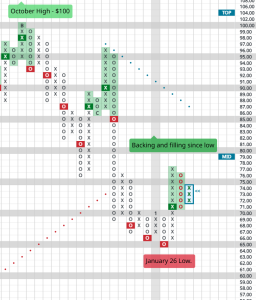

Pure Storage (PSTG) presents a different picture. While it is currently less attractive due to negative relative strength compared to the sector, there is a setup here for the bottom-fishing investor. The stock recently broke a triple top at $71, a constructive first step. We are now watching for a subsequent double-top break above $78. If that level clears, it would confirm a “bullish catapult” formation – a powerful signal that should create significant confidence that a durable uptrend is underway.

The Outlook for 2026

Do not expect this situation to resolve in Q1 or even Q2. Building new fabs and qualifying new production lines takes time. We are looking at a tight market for the entirety of 2026.

For our clients at Granite Wealth Management, the message is clear: volatility in the tech hardware sector is noise, but the shortage itself is the signal. We are witnessing the tangible financial impact of the AI revolution moving from software hype to hardware reality. The “crisis” in memory is simply the market repricing a scarce resource that has become the fuel for the next generation of global growth.

Stay disciplined, watch the trends and as always, let the market tell its own story.