Artificial intelligence may feel like an abstract force, but at its core, it runs on very tangible hardware: servers. These aren’t the everyday machines that host websites or email systems. AI has reshaped server architecture, creating a new class of high-performance systems purpose-built to handle the immense computational demands of training and running advanced models.

Traditionally, the CPU was the “brain” of the data center, excelling at sequential tasks. But AI requires trillions of calculations performed in parallel – a challenge CPUs weren’t designed to meet.

Enter the GPU. Originally built for rendering graphics, GPUs thrive on parallel processing, making them the workhorses of modern AI servers. Today, an AI server is less about a single CPU and more about clusters of GPUs working together, with CPUs orchestrating the flow.

Of course, raw power is only part of the equation. These components must be housed, cooled and interconnected efficiently. Rack-mounted servers offer flexibility and space for multiple accelerators, while blade servers maximize density by sharing power and cooling across slim, modular units. High-speed interconnects like NVIDIA’s NVLink and InfiniBand act as the “superhighways” that allow GPUs to communicate seamlessly, transforming many processors into one cohesive computational engine.

For investors, servers represent the physical foundation of the AI economy. The opportunity extends beyond chipmakers like NVIDIA and AMD. Companies such as Supermicro, Dell and HPE specialize in integrating these components into optimized systems, while hyperscale cloud providers like Amazon, Microsoft and Google are designing custom chips and server configurations to gain an edge.

In short, servers are the silicon heart of AI – where design, efficiency and supply chains converge to determine the pace of innovation. Understanding this sector is key to identifying the players who will shape the next stage of technological growth.

Let’s take a look at a couple of stocks in this sector from a technical perspective and how their two recent pullbacks look quite different from one another:

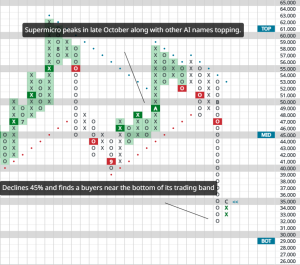

Supermicro (SMCI)

As can be seen below, this stock has been cut in half since September (reminder: numbers and letters signify months in our charts):

After a long selloff that took it near the bottom of its expected trading band, it has finally turned up recently. We would not expect a stock that has broken this badly to rally higher in a straight line.

Instead, let it pull back into the low $30’s after this first bounce, then decide if/how you want to set a stop. A low-risk stop would be set just below the most recent column of O’s, with a print of $31.

To us, however, SMCI is not very attractive. Let’s look at one that’s does:

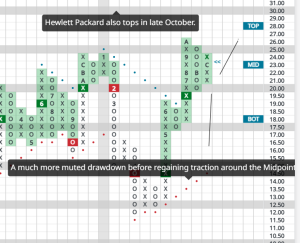

Hewlett Packard (HPE)

Here’s a stock that held up very well during the recent selloff:

It was never extremely overbought, then pulled back to the middle of its expected trading range. We gravitate toward names showing positive relative strength, and this is one such stock.

The charts above, however, mark only this moment in time in the sector that is not only red hot with interest, but is certain to change our world.

Want to dive deeper into the companies, strategies and investment opportunities driving AI infrastructure? Download our full AI whitepaper to explore the complete picture.