Sentiment around the stock market lately has revolved around how “narrow” the market is, meaning that there are not a large percentage of equities participating in the upward direction of the market. It’s worth considering, though, that year to date (YTD) the S&P 500 is up 14%, the NASDAQ Composite is up 18%, and the Dow is up 4.5%.

Nvidia’s meteoric rise has accounted for a third (wow!) of the returns for the S&P, and the rest of the Magnificent 7 (Microsoft, Amazon, Meta, Apple, Google, and Tesla) have mostly aided in those market index rises.

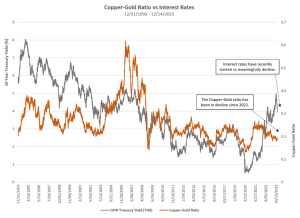

A metric that we regularly review, bullish percent (which highlights which stocks are controlled by high demand, or high supply, and subsequently rising/falling in price) has retracted slowly and steadily since the start of the year, emphasizing the dwindling participation across the equity market. Right now, the bullish percent of the New York Stock Exchange (NYSE) sits at 50%, meaning half of the stocks in the index are in a positive trend.

Another metric, the overbought/oversold (OBOS) reading, tells us where the price of an equity sits inside its data-defined trading range (more selling drives down the price, though allows potentially more favorable entry points for new positions; more buying extends the price higher, though can be an indicator of a coming price decline). OBOS currently sits at 85%, an extended overbought position, and something to pay attention to moving forward.

The major market indexes have all recently hit new all-time highs (ATHs), and the S&P has hit a new ATH 33 times this year so far.

The “feel” to the market could easily sway one to think, “this can’t go much higher much longer, right?” The data tells a different story, though it’s worth noting that what has happened in the past does not equal what will happen in the future.

Compiling instances since 1997, it has occurred 17 times where the market sits near ATHs, the market is in an extended overbought position, and the bullish percent is heading downwards. Forward returns from those instances are not very favorable up to 90 days out (average return is -2.5 – 0%), but at 180 days, the returns become very favorable – positive 5.5%, with 1-year forward returns (8.7%) and 2-year forward returns (15.7%) showing us, yet again, why holding investments, even when it doesn’t “feel” right, is how you continue to grow your wealth.

The lesson here in equity investing is this: buy and hold stocks and funds that are stronger than their counterparts and the market, allow the market to prove with conviction that the investment environment has changed before you make major changes to your portfolio. Your “feeling” just might make you miss out on what’s coming. There are some storm clouds, but it’s not worth canceling the cookout just yet.