We’re hearing a lot of warnings about Nvidia’s stock price lately (NVDA), how it’s an amazing company that is also as overbought as Cisco (CSCO), another great company that had an all-time CEO, was at the top of the internet bust in 2000. (Disclosure: we own NVDA shares personally and on behalf of clients)

Clients know that with some rare exceptions, we generally skew here to the bullish, get-in-and-stay-in side of markets. That having been said, investor concerns about Nvidia’s valuation today aren’t without merit.

A Meteoric Rise

The numbers that follow were as of last week when NVDA was at its peek. Since we remain close to those levels today, the points below remain valid and timely.

Let’s not forget that the company’s run has been amazing not only this year, but over the past 20! Consider these statistics:

- Nvidia’s stock has experienced an astonishing 817-fold increase over the past 20 years.

- Over the past decade, it has seen a 290-fold increase.

- In 2024 year-to-date, the company’s market capitalization has added a staggering $2 trillion in just one year!

Saying these numbers are impressive would be the understatement of the year. However, it’s also fair if they create a sense of unease in some investors.

Valuation Concerns

Nvidia’s forward price-to-earnings (P/E) ratio is 45, which doesn’t seem out of line considering the company’s growth rate and estimated 2024 earnings per share (EPS) of roughly $3 – although there’s a wide variance in forward-looking estimates.

However, when we look at the forward price-to-revenue (P/R) ratio, things get a little more head-spinning. Nvidia is trading at an astonishing 27 times its forward revenue! This is a significant departure from its historical norms and raises questions about the sustainability of its growth.

Growth Comps Become Challenging

Nvidia’s year-over-year (YOY) revenue growth has been remarkable, with a 262% increase in the most recent quarter. However, this growth is largely due to blowout run that started a year ago on the back of the AI data center buildout globally.

Sequential quarterly revenue growth has only increased by 18%, which means that the company’s growth rate is likely to slow down in the coming quarters.

Now, 18% is a quarter-over-quarter growth rate that any other company would celebrate. For Nvidia, however, that pace represents the beginning of a slowdown in its rate of revenue growth. Can the company keep posting nearly 300% Y-O-Y growth? Of course not, which means that at some point, the market may think about assigning a different valuation the stock.

Cyclical Nature of the Industry

It’s essential to remember that the semiconductor industry is cyclical.

Investors have gotten amnesia over this fact, but Nvidia itself experienced two negative sequential quarters of growth as recently as calendar year 2022, followed by a flat quarter, and that revenues for calendar 2023 were flat vs. the prior year.

It’s a chipmaker, meaning it’s cyclical; the company’s growth is not immune to fluctuations.

No Competition in Sight?

Some seem to believe that Nvidia’s dominance will continue unabated. However, I suspect this is a flawed assumption. Competitors will improve their offerings and when they do, Nvidia’s growth will be challenged.

AMD, Broadcom, Intel, upstarts like Groq (different from Elon’s Grok AI… this one is funded by Chamath Palyhapitiya)… they’re all just going to sit still and forever let NVDA swallow up these revenues and earnings by itself? Hardly.

Conclusion

So what is an investor today supposed to do?

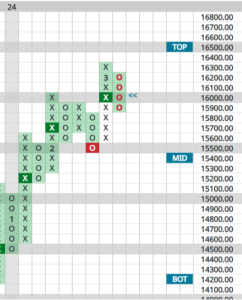

First, I’d say they should always keep this chart in mind:

And that’s just a 5-year view! Can anyone argue that stock is a bargain or that you’re the first to discover it? What, is a $3 trillion company supposed to double again? Just keep common sense in mind when thinking about what to do.

And that “what to do” depends a lot on whether one already owns the stock.

For those who do – even those who have only held it year-to-date – those buyers are up big. Selling even a small portion of one’s position would allow most investors to take, say, their original investment off the table, leaving only house money to ride things out from here.

What if you don’t yet own NVDA but want to get in? I am by no means saying the stock has peaked – there’s no way to know that, of course – only that its growth will get more challenging from here.

For those thinking of buying for the first time, patience is warranted. Buying on pullbacks is a fine idea, with an exit plan (stops) in mind. You can make things easier on yourself if you buy only partial positions on dips, meaning you’ll be willing to buy more if it goes even lower after your first purchase – still with a plan to get out and limit losses if things break down.

Again, we tend to stay in the market. We’re looking for sectors and stocks exhibiting superior relative strength and favorable growth rates that we believe can be held long-term. I’m no Rockefeller but I’ve been fortunate enough to build a net worth bigger than anything I would have dreamed of by generally staying in the markets over these many years.

But sometimes a cold, clear-eyed look at the data gives one pause. If the numbers behind Nvidia today don’t give investors a least a little feeling of concern, we would urge them to think about it again.