We have written extensively about the similarities between the Roaring 1920s and the Roaring 2020s. This thesis, coined by Ed Yardeni, is based on the disruptive technological changes and the societal and global conflicts seen in each decade. In each case, these events led to a boom in productivity growth, which we believe we are in the midst of.

Let’s break this down into two parts: the Roaring Economy and the Roaring Stock Market, which can sometimes be two different animals.

Roaring Economy

Implied in the Roaring Economy is a trend of strong corporate earnings. As the economy hums along, and as long as no recessions hit, this trend continues as it has been. This is true even though analysts, on balance, have been consistently inaccurate by underestimating GDP, S&P company revenues, earnings, and margins. The life of the one-armed economist is difficult in these new economic boom times.

The absence of a recession is also a key ingredient. That has been challenged by the initial, negative Q1 GDP reading, which was a knee-jerk reaction. The US economy is now largely a technology and service economy, as manufacturing is a small percentage of growth. Seemingly, there has been no recession in technology, only what Ed Yardeni calls a “rolling recession” that has seen housing and manufacturing take their turns declining.

What about the effect of AI on the labor market and inflation? Will it shrink further? Yardeni continues:

“A tight labor market plus continued investment in new technologies like AI, robotics, and automation will help keep a lid on unit labor costs and therefore inflation.”

What about the amount of debt and the “bond vigilantes”?

The US reserve currency status goes hand in hand with foreigners buying our bonds and thus financing these deficits. Might that change? Possibly. To date, attempts by other global heavyweights to replace the reserve status of the dollar have had limited effect.

Roaring Stocks

Stock prices are pushed and pulled by their master: earnings. In theory, they are worth only what investors are willing to pay for their earnings stream. In practice, the supply (from sellers) and demand (from buyers) for a stock dictate the daily price prints.

The terms “bull market,” “bear market,” and “correction” are freely bantered about today. I have felt that the 20% drawdown signifying a “bear market” and the subsequent rebound to the starting line signifying a “bull market” are totally arbitrary benchmarks. I’d say the same for the 10% “correction mode” status. Where did these benchmarks come from?

I think it’s much more important to focus on “structural bull” or “structural bear” markets. These are defined by long-term trends that experience drawdowns within the context of significant price appreciation. These typically last 12 to 18 years or so, whereas bear markets are generally much shorter, lasting one to two years. What about the “lost decade” of the 2000s? Some have called this a “structural fair market.”

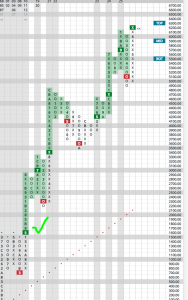

Furthermore, there is the question of when a bull market truly starts. I have long felt that a new bull market begins when it eclipses the old highs of the previous uptrend. For example, the market made an all-time high in July 2008, just before the Great Recession took hold. What followed was a decline of more than 50%, culminating in the generational low of March 2009. It wasn’t until May 2013 that the market was able to eclipse the previous high and thus initiate a new bull market. May 15th, to be exact, as indicated by the green checkmark on the chart.

If one uses this definition of May 15, 2013, and adds 18 years—the upper end of the historical bull market duration—that brings us to May of 2031.

What are the odds of this coming to be? It is difficult to put a number on that, but let me just say that if the earnings trend continues to increase at the current trajectory and technological innovation unfolds at this pace, then the odds are very good. The key driver is productivity growth. Corporate America can get by with fewer line workers (who will hopefully find jobs in yet-to-be-determined emerging new industries), improving their net margins as the reduction in expenses falls to the bottom line.

What are the Roaring 2020s’ implications for different asset classes?

- Stocks – They will likely continue booming, but be prepared for sudden drawdowns that will make you question the “Roaring” thesis. Don’t get shaken out of the market by these short-term blips; just be glad you are invested in stocks. Choose holdings that are oriented toward capital appreciation and are technology- and innovation-centric.

- Bonds – Expect pedestrian returns on capital invested and decent income during your holding period. We are not going back to zero interest rates.

- Commodities, including precious metals – Mixed. As inflation and global macro fears become more rational, gold’s rise should be tempered. On the other hand, strategic metals may become more interesting as securing adequate supplies becomes more important for corporations and nations.

- Real estate – Localized, with varying returns depending on geography. In well-heeled, monied areas, expect the rise to continue, fueled by Boomers’ gains in the roaring stock market. They go hand in hand. Sunbelt areas should be much more challenging due to insurability, affordability headwinds, and changing migration trends.

- Crypto – You’ve got me. Legislation is all over the place, promoting some and demoting others.

Whatever your favored vehicle is, remember that we are in an incredible period of wealth accumulation.