The Federal Reserve made its long-awaited move this week, cutting interest rates by a quarter-point. This decision has poured fuel on the fire for interest-rate sensitive stocks, which were already rallying in anticipation of the cut and have continued their strong performance in the days since.

A prime example of a stock thriving in this environment is Rocket Mortgage (RKT). The company, a major player in the mortgage industry since 1985, has seen its stock make a powerful comeback. This recent surge has RKT once again making a run at its 2021 all-time high, a bullish trend we’re seeing mirrored across the entire sector in areas like homebuilders and building supply companies.

The driving force behind this move can be seen in the bond market, specifically in the action of the 10-year Treasury yield (TNX). As yields fall — recently dropping toward the 4% level — it creates a more favorable environment for the housing market and mortgage lenders. However, this has become a very popular trade, and as we’ve seen time and again, crowded sectors can be prone to sharp increases in volatility.

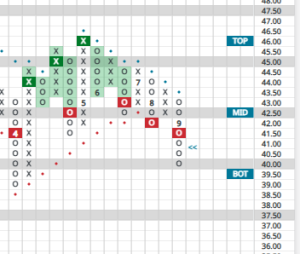

To get an objective look at where yields are and where they might be headed, we’ll start by analyzing the Point & Figure chart of the 10-year Treasury yield.

Investors have been played at this level before so continued declines are not guaranteed, yet the trend is certainly in the favor of those hoping for continued lower rates.

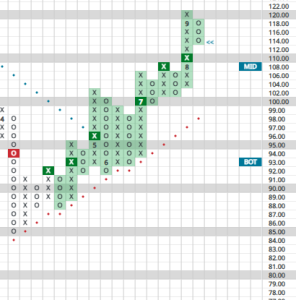

Are Homebuilders Flashing a Warning Sign?

With Treasury yields in decline, one would expect interest-rate sensitive sectors like the homebuilders to be major beneficiaries. So, is it time to sell on the good news?

A quick look at the Homebuilders ETF (XHB) might tempt you to do just that. As you’ll see in the Point & Figure chart, the ETF has just printed a small, negative reversal into a new column of O’s. Given that this reversal happened near the top of its recent trading range, some will undoubtedly view this as a classic “sell the news” event and a reason for caution.

However, we are less concerned about this first pullback. Historically, the start of a Federal Reserve rate-cutting cycle isn’t a one-day event; it’s the beginning of a trend that often provides significant tailwinds for the housing sector over time. Therefore, we see this minor reversal less as a bearish warning and more as a healthy consolidation before the sector’s next potential move higher.

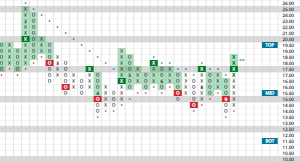

Finally, let’s turn to the main event: Rocket Mortgage (RKT)

As you’ll see on the Point & Figure chart, the stock has spent much of 2025 consolidating and “building a cause” as the market anticipated the Federal Reserve’s shift in policy. The recent breakout from this long consolidation phase is significant, as it has now generated a bullish price objective for the stock in the low $30s.

However, the path to that objective won’t be a straight line. The stock has a considerable amount of overhead resistance to work through from sellers who bought at higher prices, with a notable supply expected in the high teens to low $20s.

Given this setup — a promising long-term target but with significant short-term hurdles — patience is essential. Rather than jumping into a full position at the current price, a more prudent strategy would be to consider scaling in with partial purchases, especially on any constructive pullbacks. This approach allows an investor to build a position for the long-term target while respecting the overhead resistance that needs to be cleared.

In conclusion, the Federal Reserve’s rate cut has signaled a more favorable environment for interest-rate sensitive stocks. As we’ve seen through the charts of Treasury yields and homebuilders, this doesn’t guarantee a straight shot higher, as volatility and consolidation are natural parts of any new trend. For a stock like Rocket Mortgage, this backdrop creates a clear opportunity for the patient investor, allowing one to look past the short-term noise and use key technical levels to strategically build a position for the larger move that may be ahead.