Some investors still don’t own any precious metals and wonder if now is the time to buy. Others have been holding for years, sitting on sizable gains, and are debating whether to lock in profits. And then there are those who bought recently—at higher prices—now questioning if they’re in trouble.

The age-old dilemma—buy, sell, or hold—is often a matter of timing. Without offering specific investment advice, let’s take a brief technical look at gold’s current setup and outline a few strategic considerations.

Strategy 1: Buying the Dip—But How Deep?

For this article, we will use the largest gold ETF, GLD, as our proxy for the metal.

GLD’s recent pullback from $400 to the $365 range may feel significant but technically, it hasn’t yet reached a compelling buy zone. The top of its trading band sits at $375, and the midpoint – often a consolidation target – is around $345. A more attractive entry might be closer to $320. If momentum weakens further, the $295–$310 range offers strong support and could represent the optimal buying opportunity. In that case, much better, tighter stops just below support could help manage downside risk, especially if gold threatens to retest the $250 zone.

In short: those interesting in buying cold should likely exercise patience.

Strategy 2: Protecting Gains

If you entered early in the year around $255, you’re still sitting on a healthy gain of approximately 45% even after this recent pullback.

What I often see with such holders is this: they miss the top, then despite knowing that the technical picture has broken down and gains have been taken, they start thinking ‘if it will just get back up to _____ (dollar price), I’ll sell.’ In this case, one might hope for a return to all-time highs at $400 to then take profits (‘I won’t miss it this time!’).

Maybe that will happen. Or, perhaps that investor will end up waiting years for that outcome to occur, if ever. Don’t get too cute with trying to nail the top when you know it’s time to protect at least a portion of your gains.

Strategy 3: Waiting for Confirmation

Another approach is to wait for gold to “back and fill” and then act on a confirmed breakout. Ideally, this would occur near the lower end of its trading band, signaling the end of consolidation. However, recent false breakouts have lacked follow-through, so tight stops are essential if you choose this path.

In short, gold’s technical picture suggests caution. Whether you’re looking to enter, exit or simply protect gains, understanding where we are in the trading band can help frame your next move.

To get a clear view of trading bands, let’s next look at silver, including a chart below.

Silver: The Penny Stock of Precious Metals

Silver often behaves like the penny stock of the precious metals world – less respected than gold, but capable of explosive moves, especially near the end of bull market cycles. Just as equity investors chase smaller-cap names late in a stock market rally, precious metals traders often rotate into silver after gold has made its run. Historically, silver’s surge has been a signal that the party may be nearing its end.

Fundamental narratives around silver – industrial demand, central bank flows, and supply constraints – are often cited. But in practice, silver trades more like a high-beta version of gold, responding to the same macro forces but with amplified volatility. It’s not uncommon for silver to outperform gold in percentage terms during the final stages of a rally, and 2025 has been no exception.

At its recent peak, silver nearly doubled year-to-date, outpacing gold’s performance and attracting attention from momentum traders. But now, it’s consolidating alongside gold’s sharp selloff last week, which we covered earlier. This lockstep behavior reinforces the idea that silver’s fate is tightly bound to gold’s technical picture.

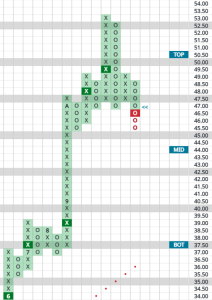

It is easy to see in the chart above how extended silver was recently, particularly when viewing its trading bands.

For those holding silver, there is a tiny bit of support is at $45, then weaker support simply being the the mid-point of the trading band at $44. That level offers a buffer against deeper downside while allowing room for continued consolidation. If silver breaks below that threshold with conviction, it could signal that the speculative froth is unwinding and that the top may already be in.

As with gold, timing is everything. Silver’s dramatic rise and current pause suggest caution. Whether you’re looking to enter, exit or simply protect gains, it’s worth remembering that silver tends to move fast – and often marks the final chapter of a precious metals rally.