Investors are impressed with yesterday’s earnings releases and look forward to greater

flexibility for this sector, particularly for M & A, thanks to a benign inflation reading and

the return of hope surrounding future rate cuts.

What I wanted to point out is something a lot of investors might not have noticed: banks

did not experience any drawdown in the recent 7% selloff, which centered primarily around growth stocks. Value stocks have held up well during this period.

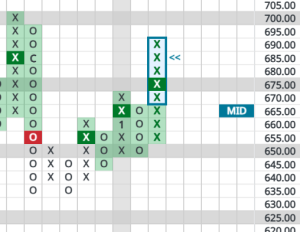

Dow Jones US Bank Index

Remember, X’s are rising columns. Since the reversal up into X’s in December (the C in

the long column of O’s denotes December – numbers 1-9 are Jan-Sep, while Q4 months

are shown with A, B and C), we have seen a steady pattern of higher highs and higher

lows despite the overall weakness in the market.

We find relative strength like this in any sector to be compelling, so what might the

strong recent performance by the banks be telling us?

While the Federal Reserve cut short-term interest rates by 100 basis points in the 4 th

quarter, the long end of the yield curve actually rose by 100 basis points. This is a very

unusual development which, for a while, had investors concerned that policy makers

had made a mistake in cutting rates.

If inflation is seen to be vanquished, however, investors may quickly note that what

we’re left with is a steeper yield curve, which should mean bigger profits among banks

in the months to come.

Further, this setup may also tell investors to brace for stronger-than-expected growth.

These possibly bullish conditions are still subject to investors’ views on future inflation,

but they could lead to even more gains in financial and banking stocks going forward.

Here are two names to look at:

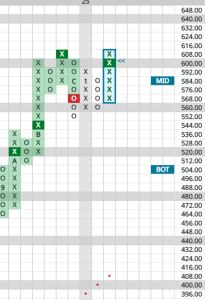

Goldman Sachs (GS)

What you see here is healthy relative strength from this leading investment bank, similar

to the sector as a whole. For those worried that the stock is at all-time highs, in this case

the powerful performance despite a down market is attractive and a break to new highs

above $616 would signal more upside to come, perhaps into the high $600s, for

starters.

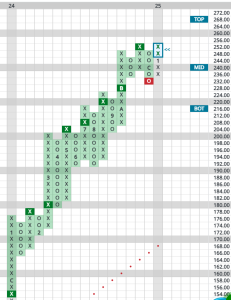

JPMorgan Chase (JPM)

Here, you see an orderly series of higher highs (rising columns of X’s) and higher lows

(declining columns of O’s) that goes back over a year. Another stock that’s about to

break to new all-time highs, a move to $256 would confirm that the uptrend remains in

place.

We don’t tend to overweight this sector in client accounts but for any investors out there

wondering if it’s too late to look at bank stocks after yesterday’s rally, we would say “no.”