The last 10 days have been so crazy, politically, that investors could be excused for failing to notice the fireworks that took place in the stock market last week.

For those who did notice, many are getting worried that the extreme selling late in the week may portend a looming market crash.

But what would a crash look like ahead of time?

Anyone who says he or she can nail the top of the market is either A) Nostradamus or B) delusional. That said, it would be highly unlikely for a bull market to reverse suddenly with absolutely no warning signs.

What do the signs look like? For those of us obsessed with analyzing supply and demand, clear signs of supply taking control start to emerge.

Since the October, 2022 low, demand has been in charge. As stocks have advanced, most have tended to make a series of higher highs and higher lows. Pullbacks might have seemed worrisome at some moments, but cold, clear-eyed analysis has shown the overall patterns to be orderly and consistent with a bull market.

When a stock is starting to break down for good, supply will take control. That may seem like an obvious statement but what I mean is, there are visible signs that the trend of increasing investor demand is reversing.

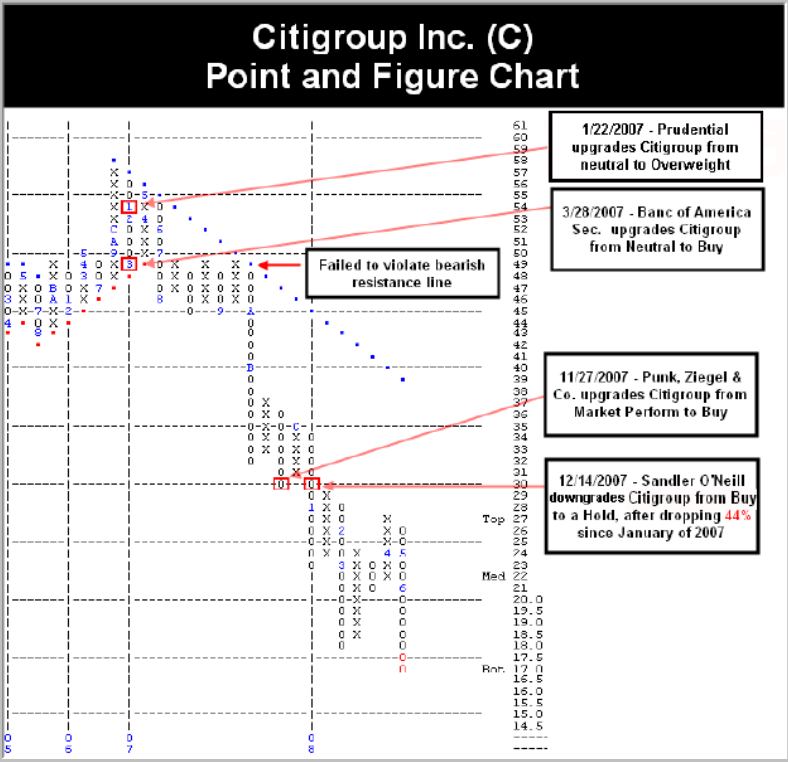

Borrowing some content (by permission) from our friends at NASDAQ Dorsey Wright, let’s look at a big, familiar name from the great financial crisis, Citigroup (NYSE: C).

“During 2005 and 2006, Citigroup was making great advances, creating an all time high of $57 in December of 2006. Then, after a period of consolidation in early 2007, supply took the helm of this ship. Citigroup began its course for a downward trend that would lead to a phenomenal technical collapse with a breakdown at $48, which violated the bullish support line and caused the overall trend of this stock to shift to negative. During the later summer months of 2007, C was unable to penetrate its bearish resistance line despite 3 valiant efforts to do so, and then ultimately broke down again at 44, a spread quadruple bottom cell signal. Despite the technical breakdowns in the stock, the deteriorations were not yet apparent in the fundamentals of the company.

“As a matter of fact, there were multiple fundamental upgrades on the stock in early 2007 in the upper 40s to mid 50s as firms upgraded the stock to a buy or overweight posture virtually at the top. Even in November and December of 2007, there were a couple more fundamental recommendations to buy the stock after it had nearly been cut in half.”

“While there were still many people that felt Citigroup was a good company, the health of the stock did not warrant a buy recommendation if you were just willing to follow the point and figure chart.”

True.

Further, we would say that not only is Point & Figure analysis unemotional, it is also humble. It says the market collectively is wiser than any one person, but that it also leaves tracks for those willing to read them.

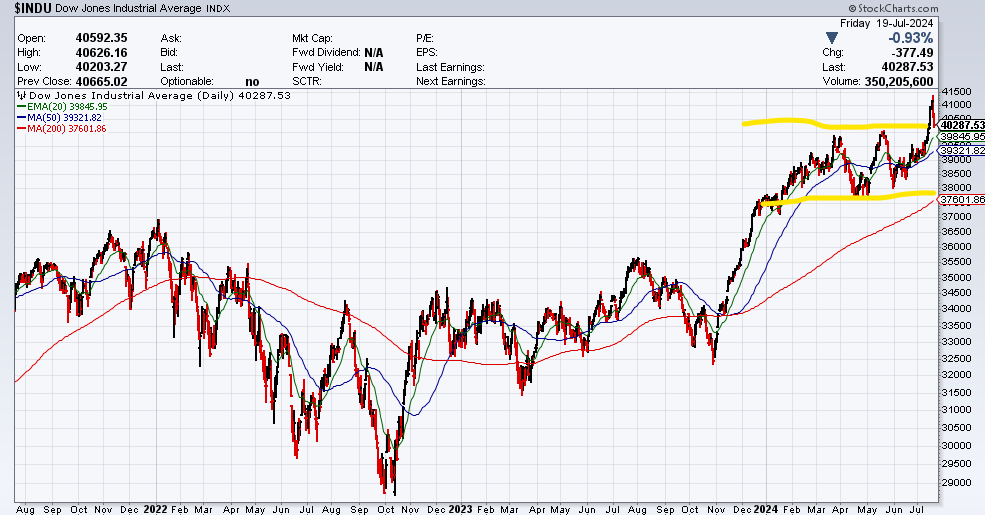

Regardless, what about our current market after last week’s rough ending?

It will take more than a slight pullback to move us off the bullish position we’ve held since October of 2022. Could we be on the precipice of a big sell off? Sure, but anyone predicting that is just guessing at this point, in our view. We would need to see a series of technical breakdowns showing that demand has indeed taken control.

This approach means we’ll never nail the exact top of the market, but it also means we’re more prone to staying with successful positions in the long run, able to ignore prognostications of doom along the way (of which there have been many).

Indeed, even a simple bar chart of the Dow Jones index should cause investors to relax and keep their wits about them:

Yes, the market might have gotten a little extended recently but that was after a break to new highs, which often witnesses a pickup in momentum. The flip side of that coin is that the 37,500 to 40,000 range the market has spent most of this year in should now act as meaningful support.

Bottom line: those calling a top and promising an imminent collapse are merely guessing. There’s a lot of business in doom and gloom – indeed, many in our industry build their personas on pessimism – but the reality is that as of now, there is no cause for stock market alarm.