Has Apple (AAPL) hit a wall at $200?

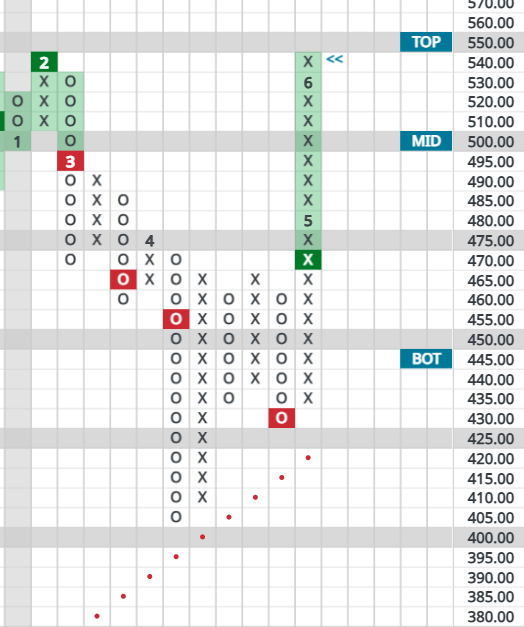

August was not especially kind to the stock after hitting an all-time high of $198.23 on July 19th:

Perhaps weighing on it in the short term is the fact China has put limitations on government employees’ use of iPhones — likely a retaliatory move against both the U.S. for limiting chip shipments and Apple’s privacy policy.

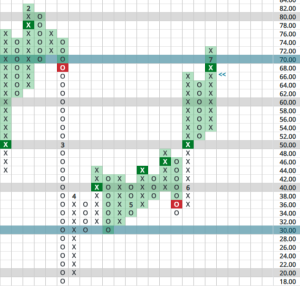

Many times in the past, Apple’s growth prospects have come into question but the stock’s performance over the long-term tells a different tale, of course. It has been on a relative strength buy signal — indicating its outperformance vs. the S & P — since March 10th, 2004!

Put more simply, the results over that time are stunning:

Apple up 35,823%

S & P up 296%

We have held it in our portfolios for some time. We consider it a core holding and have current no plans to exit. What would change our minds about Apple?

A relative strength Sell signal. But that would take place at a price roughly 1/3 lower than today’s.

In this case, take Cramer’s advice on Apple: don’t sweat the short-term corrections. Own AAPL, don’t trade it.