Following last week’s fundamental conversation about artificial intelligence with an IT industry guest, we’re preparing to dive into some stocks that may benefit from the booming adoption of all things AI.

Before we can look at individual names, however, we must first evaluate the health status of the sectors in which these stocks trade. But before we do even that, a quick reminder on how we approach analyzing the market from a technical perspective.

Market / Sector / Stock

In looking for stocks to buy or sell we take a top down approach. First and most importantly, we assess the technical health of the overall market as represented by some of the largest indices, as well as long term indicators I described in detail in our recent third quarter outlook.

As I described in that article earlier this month, we remain in the bullish posture we’ve been in since October.

After making a bullish or bearish determination on the market as a whole, the next thing to do is analyze various sectors. When the market and a sector are both either bullish or bearish, it is very rare to see any individual stocks within that sector buck the trend.

Only once an investor has developed a view on the market and his or her favorite sectors should that investor then look to buy individual names. Today, we will take a quick at three sectors that should have above-average exposure to the AI phenomenon – Dorsey Wright’s Internet, Semiconductor and Software sectors.

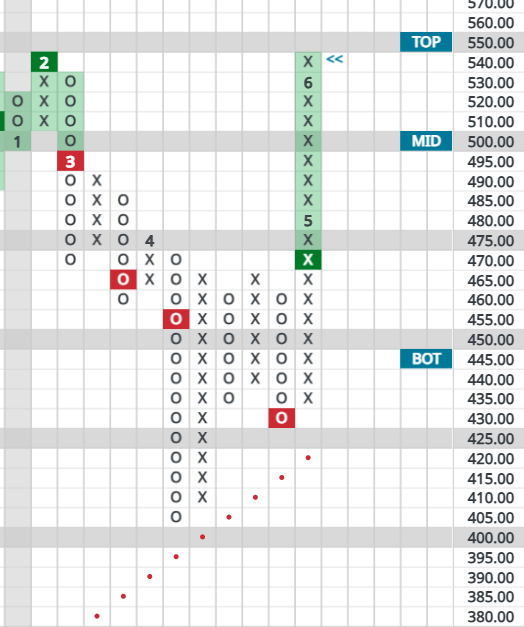

DWA Internet Sector

DWA Semiconductor Sector

DWA Software Sector

As always, rising trends are represented by X’s, while numbers you see in the charts represent months. Returns have ranged from 12% (Software) to 29% (Semiconductors) since May.

Each of the charts above share some other key traits.

First, they’re all in “bull confirmed” mode on a technical basis. Long story short: a series of higher highs and higher lows after a reversal up from oversold conditions means demand has control in the longer run.

In the short term, however, each sector does look a bit extended, either bumping up against a downtrend line or having moved above its short-term expected trading band. This means new commitments should be made only partially. As long as the overall market remains bullish, though, saving new ammunition in case of a pullback is the way to approach.

Now, it should be said that the sectors above are not pure plays on AI. There are some indices and ETFs today which claim to be AI focused but some are not well constructed, containing too many companies that have little claim of being AI plays.

This is why we at Granite Wealth are currently constructing our own proprietary indices, which we will launch soon and we hope to use to better capture the AI sector (and others we’re working on).

For now, however, we can say this: the market is bullish. Tech-related sectors are also bullish, but extended short-term.

Next: finding individual stocks within these sectors that look most appealing from a technical standpoint.

That search for specific AI stocks is exactly what we’ll be doing in our next blog post. Stay tuned!