As investors know, gold has ramped over the past few weeks – unexpected with inflation readings falling across the board.

Then again, the precious metals did not break out of their longer-term ranges when the inflation scare was at its height a year ago. Have the facts changed or is this simply a case of asset class shuffling?

Some air has come out of the Magnificent Seven and it must go somewhere. Could it be these commodities are now viewed as growth assets? We’re dubious on that point.

For many stock market sectors, we develop clear fundamental opinions based first upon technical action. For precious metals, however, we leave explanations of their moves at the curb. Along with the few who provide genuinely compelling commodities insights, there are just too many uninteresting gold bugs – the stock market and dollar perma-bears – for us to feel like weighing in too frequently or too strongly.

Still, we can’t ignore the recent action in gold, silver, crude oil and Bitcoin. Let’s look at their charts.

Gold

Why did gold stagnate over the last couple of years, against the recent environment of rapidly rising inflation? To me, one interesting thesis is that Bitcoin has permanently siphoned off some of gold’s demand, but we’ll leave the reasoning up to you.

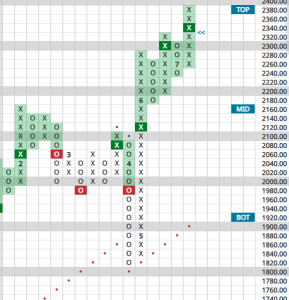

As for price action, its 2022-2023 trading range has seen it bounce between $1650 and $2080 – until last week. Recent breakout points to potentially a $2380 print.

That said, the Point & Figure chart above (X’s are rising columns) shows that gold is extended beyond its expected short-term trading range. For those with new money, waiting for a pullback seems a wise course of action.

Silver

The younger and more speculative cousin of gold, some of the savvier precious metals fundamentalists we follow view silver as the “penny stock” of the precious metals. That is to say, just as the lowest-quality and penny stocks tend to rally most late in bull markets, upward thrusts in silver often marks a top for the group.

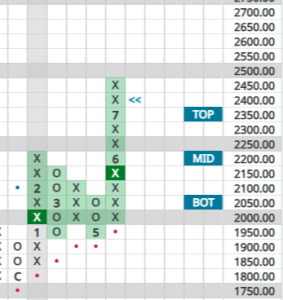

In the chart above, silver has made a minor technical achievement by way of a triple top breakout at $25.50. However, we would be more fired up about this action if this metal weren’t also at the top of its expected range and still working through some longer-term resistance. This break could set the stage for a run at $30, last seen in 2021. Worth the risk

Crude Oil

Meanwhile, crude is acting much more like we would expect in an investment environment that has become much less worried about inflation. Long thought of as a proxy to economic activity, what is it forecasting now? A slower economy? There certainly isn’t a clear read on inflation when pairing the action of this commodity with the precious metals.

To become bullish on oil, we would need to see some technical healing – at least one reversal of this downward trend, which would mean a rising column that exceeds a prior column of X’s. The only mild positive, shown in the chart above, is that oil is nearing the bottom of its trading range ($67) so perhaps most near-term damage has already been done.

Bitcoin

Ah, the gold and sovereign currency alternative. The weak dollar environment we’ve seen recently could be fueling its rise; indeed, the US Dollar index superimposed over this cryptocurrency tracks very closely since late October. We have no interest in digging into fundamental explanations of Bitcoin’s ups and downs.

In the case of Bitcoin, the triple top breakout at roughly $32,000 lead to a powerful burst higher. Unlike Silver’s recent triple top, however, Bitcoin’s move came from within a normal range on its trading band. For now, it is also quite extended, which leads us to be skeptical that any of the non-Dollar assets will move a lot higher from here in the short run.

Conclusion and Stops

While it remains to be seen whether these breakouts will bring further upside momentum, those interested any of the non-Dollar assets (gold, silver, Bitcoin) can look at taking partial positions and adding on weakness – or merely waiting for pullbacks to initiative positions in the first place. Then, traders would be wise to adhere to the following stops:

- Gold – $1940

- Silver – $22.50

- Bitcoin – $31,900

And as for crude oil at the moment? Avoid.