As we share post written blog content, we realize that for most investors, looking at the Point & Figure charts we rely on is like reading a foreign language.

Thus, from time to time I will share short primers like this one – articles that explain one element of P&F charting more fully and can sometimes be linked back to in future articles when referenced.

Today, we start with one of the most basic fundamentals, a feature that is meant to slow down one’s thinking and help filter out the noise of small, sudden mvoements.

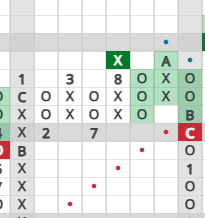

Point and Figure charting is unique in its price-action focus on the market. Unlike time-based charts, it only plots significant price movements, filtering out minor fluctuations and noise. One of the fundamental concepts in Point and Figure analysis is the 3-Box Reversal, a crucial signal for identifying potential trend changes.

So, what exactly is a 3-Box Reversal? Simply put, it’s a reversal signal that occurs when the price moves three dollars (or ‘boxes’ as we call them… more on that in a minute), nothing less.

In a column of X’s (indicating an uptrend), a 3-Box Reversal is triggered when a column of O’s forms and extends for at least three boxes below the highest box in the preceding X column. Conversely, in a downtrend represented by a column of O’s, a 3-Box Reversal occurs when a column of X’s appears and rises at least three boxes above the lowest box in the prior O column.

Smaller 1-2 point moves are filtered out, which leads to clearer pictures and repeatable, recognizable patterns we can act on.

A key element of constructing a Point and Figure chart is determining the box size, and this size isn’t fixed. It typically varies depending on the price level of the stock being analyzed. For stocks trading below $20, the box size shrinks to $0.50. As the stock price increases, the box size is often adjusted upwards to maintain relevance and avoid excessive charting. Thus, for stocks trading above $100, a larger box size of $2 is employed. These varying box sizes help ensure that the charts accurately reflect significant price changes relative to the stock’s trading range.

Why is the 3-Box Reversal so important? It’s primarily used to identify potential shifts in market sentiment, momentum and the start of a new trend. By requiring a move of three boxes, it helps to filter out minor counter-trend bounces or pullbacks that might occur within an established trend. This helps traders avoid being whipsawed by short-term volatility.