Many are afraid that the port strike may disrupt the U.S. economy if it drags on, taking stocks down with them.

Maybe.

Because we wrote last week that scary-sounding stories like these can actually lead to opportunity – in this case, a relief rally once the strike is inevitably postponed or resolved – I decided to poke around the retail sector for possible investment ideas.

The retailers haven’t been one of our top sectors for a while but two names stood out as possible buying opportunities, and for different reasons.

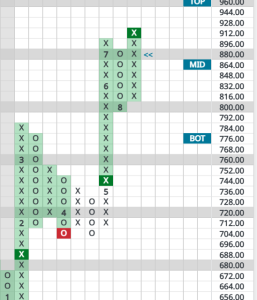

Costco (Nasdaq: COST)

This reliable, long-term performer remains in a bullish pattern, having broken a double top (column of X’s) at $744 in May, then another at $896 in August. The stock has pulled back somewhat from its recent all-time high near $920, but nearby stops are not available.

The first sign of even slight concern wouldn’t happen until a double-bottom break at $800, but then there is heavier chart support that develops in the $700s. Perhaps those who have always wanted to own COST but never pulled the trigger could consider partial positions, with the intent on adding more if it pulled back into the low $800s.

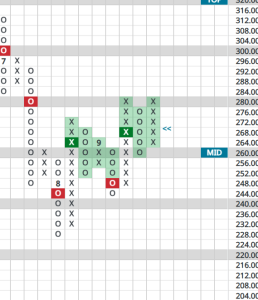

Lululemon (Nasdaq: LULU)

For those interested in a potential turnaround play, here’s a name you might not have expected.

After losing over half its value in 2024 based on a string of disappointments, the stock has been quietly stacking wins on a Point & Figure technical basis since it’s August low.

$284 would be its second consecutive double-top buy signal, while even a move below the latest column of Os could set up a very bullish Shakeout pattern of sorts. The small, recent pullback into the low $260s presents an easier entry point for aggressive traders. Perhaps use a move below $240 as a stop, which would represent a second consecutive double-bottom break (column of O’s).

Decent risk/reward opportunity here for disciplined traders.

Too bad we’re not higher on this group in general, else we would be looking more actively for bullish trading ideas against today’s headlines.