An Update on One of the Darlings, Palantir (PLTR)

On February 3rd, Palantir (PLTR) reported earnings for the 4th quarter of 2024 with a triple beat:

- Earnings per share were .14 versus .11 expected

- Revenues $828 million versus $776 million expected.

- The company’s forward guidance was what excited investor the most… quarter 1 in a range of $858 to $862 million and full year of 3.74 – 3.76 billion, above the $3.52 previously estimated.

No sandbagging of the numbers in that forecast!

The stock rocketed 22% in after-hours trading and made an all-time high of $125 a couple weeks later.

Then the Trump 2.0 mandate was put into overdrive. Concerns about its impact, particularly how tariffs will affect prices, have taken the S&P down 8.6% since its all-time print of 6,100 on February 7th. Holders of Palantir stock were alarmed by the selloff, as Trump announced a cut in military spending. Connecting the dots in knee-jerk fashion, it must be curtains for Palantir.

These threatened cuts in military spending have weighed heavily on investors even as the CEO, Alex Karp, said the company is undergoing a broader acceptance in non-military applications. Investors have so far taken this with a grain of salt and have sold shares in the broad market correction.

However, according to Motley Fool:

“In the past, Palantir has seen its government revenue growth be a bit unpredictable. In 2023, its government revenue growth hit a trough of 14% after seeing 19% growth in 2022 and 47% in 2021. It picked up to 30% growth in 2024, including jumping 45% in the fourth quarter.

“At the same time, the stock became a Wall Street darling due to the strides it was making in the U.S. commercial sector, which saw revenue climb 54% in 2024, including a 64% surge in the fourth quarter. Palantir has been gaining a lot of momentum in the commercial sector from its AI platform, which can be used to address mission-critical tasks across various industries.”

Maybe it was the announced sale of Karp’s shares that spooked the market, then?

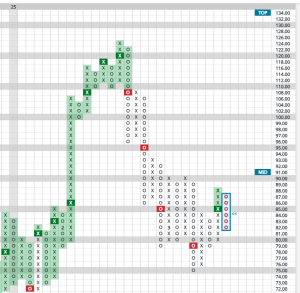

Regardless, here is the technical picture of PLTR:

From its early February peak, it initially broke important support at $110 and secondary support prior to the earnings release at $79. There has been backing and filling since then just south of the midpoint of its trading band near $91.

Strong momentum stocks that run into headwinds will typically experience this right in the middle of its band. Frequently, I find that this new base building is what launches it up to challenge its old highs and possibly eclipsing that with a higher leg up.

Does this mean it’s time to pile in and buy PLTR at these levels? Could be, but I prefer to wait for more evidence – I’ll even be willing to pay a few dollars more to get that evidence.

I will be watching for more follow-through in the form a second buy signal, which would take place at $89, before I’ll be adding to my position.

As an aside, a thought based on an interesting article: what if we are witnessing the start of the creative destruction of the Military Industrial Complex? Here’s a great read on the disruptive changes within the MIC and its ties to Silicon Valley luminaries such as Peter Theil and Palmer Luckey: