The past couple weeks have seen a return of pessimism in the markets. There’s always a reason; this time around, the yen carry trade has been blamed.

We speak to investors and clients regularly and over the years one consistent response has outweighed all others: “I don’t want to be unprepared like everyone was prior to the Great Recession,” they say.

Biases are present in many aspects of life and certainly in spades in the financial markets.

Our friends and partners at NASDAQ Dorsey Wright noted this in a recent writing:

As Richard Thaler, one of the founding fathers of behavioral finance and 2017 winner of the Nobel Prize for Economics put it, “Conventional economics assumes that people are highly rational – super-rational – and unemotional. They can calculate like a computer and have no self-control problems.

The confirmation bias sets in.

Along these same lines, NASDAQ DWA continues:

Confirmation Bias – this bias occurs when clients seek out and give credence to information that confirms their existing beliefs. Confirmation bias may cause clients to consider only the positive information about an investment and ignore new information that would contradict their investment thesis. Confirmation bias can result in clients not considering all available, relevant information about their investments.

Most of the time cognitive biases will not be as obvious as, “I think the economy is headed for a recession and every research shop seems to agree…so I must be right.” Or perhaps, “The market was obviously due for a pullback, so why did we not sell before last week?”

Then overconfidence hits…..

Daniel Kahneman, another Nobel-prize-winning economist, explained that humans are rather good at making sense of the past, but consequently, they overestimate their ability to predict the future (Source: Thinking Fast and Slow). To that point, education is typically more successful in fighting cognitive biases than emotional biases. So, if the prior statements sounded like something you heard over the past week, then a level-headed, logic-based conversation will likely do a lot of good.”

Thinking about the nature of biases as described above, can we all set our own predispositions aside to determine where markets reside today?

Asked another way: has there been significant damage to support levels and trendlines?

In short: no.

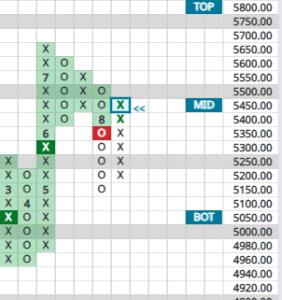

While the S&P 500 experienced a headline-making drawdown from its July 17th intraday high of 5669 to its bottom of 5199 on August 17th – 8.2 % – in technical terms, it was rather mild.

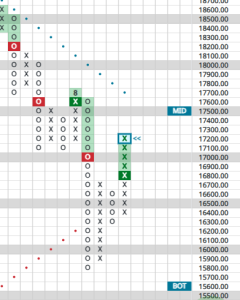

The NASDAQ universe did have a larger drawdown. You would expect this for the OTC universe, with its weighting toward earlier-stage companies and more natural volatility that results.

Top to bottom, a 15.86% drawdown for the NASDAQ in just a few days — wowza!

During this phase, short term indicators did approach oversold conditions, but not washed out conditions to suggest a low has been put in with certainty.

For the The New York Stock Exchange, its short-term indictors only pulled back to midfield – nowhere near grossly oversold extremes.

Our take from here?

Expect more backing and filling as the dreaded September arrives, October is likely to have its share of pre-Election jitters, one of the most important FOMC meetings in years and Q3 earnings. For now, however, there is no technical reason to say our bullish stance that began in October 2022 has been violated.

Staying long the market remains the play, but unbiased monitoring for technical improvements or deterioration during the 3rd quarter will be vital from here.