We occasionally are asked about after-hours trading, which are hours outside of the normal stock exchange hours of 9:30am – 4:00pm EST for buying and selling securities. Orders to buy and sell can be placed and executed as early as 4am, and as late as 8pm. There could be a myriad of reasons one might consider timing their trades against market hours, with the most common being an attempt to take advantage of after-hours news that might affect a stock’s price.

“Between pre-and post-market trading, there are significantly more outside-of-market hours during which equities and equity derivatives trade than there are normal market hours. Generally, your average investors do not do much buying or selling outside of normal market hours, nor do they invest in futures, meaning that they simply “take” the portion of the market return that is generated outside of market hours.” This “taking” of after-hours returns is inherent in a “buy and hold” strategy, where an investor tends to buy with plans to hold the purchase for weeks, months or years.

This begs the question: Is it worth trading during after-hours, especially when there seems to be some potentially favorable price swings that occur after the closing bell?

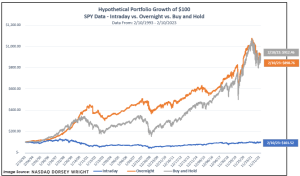

To answer that, our research partner, Nasdaq Dorsey Wright, published a short piece to examine the differences between trading approaches if an investor were to only invest in the S&P 500 ETF (SPY), which is a broad-market fund, over a 30-year period (2/10/1993 – 2/10/2023):

- Overnight Portfolio: the investor buys SPY at the normal market close (4pm) and sells at the normal market open (9:30am) the next day

- Intraday Portfolio: the investor buys SPY at the normal market open and sells at the market close

- Buy & Hold Portfolio: the investor buys SPY and holds for the entire 30-year period

The results over the 30-year backtest were interesting:

- The Overnight Portfolio gained about 799%

- The Intraday Portfolio gained 2%

- The Buy & Hold Portfolio gained 812%

In this example, the Buy & Hold Portfolio outperformed the other two portfolios over the 30-year window, “suggesting that investors would have been best off simply taking the change in closing price each day versus trying to eliminate overnight risk or only investing overnight.”

The overnight portfolio, however, was a close second, and actually was the best performing during most of the measured period.

Looking at the stats for 2023 so far would highlight, however, that intraday returns aren’t worth ignoring, despite their poor performance in the study sample. YTD (through 2/10/23), intraday returns account for 6.7% of gains. Though, it’s also worth noting that “less than 10% of months over the last 30 years have seen the Intraday portfolio outpace the Overnight portfolio by at least 5%.” This suggests that both intraday returns are likely worth trying to capture, and overnight returns are also worth trying to capture.

This strongly suggests the value in a buy & hold strategy, particularly since the buy & hold strategy will tend to “smooth out” return fluctuations that one might see with constant buying / selling, and it will also reduce (or even eliminate) any fees and taxes associated with order execution.

As a sort of “bonus” finding, what stood out when examining the rolling 12-month returns from that same study was how the Intraday portfolio tended to act before both the Buy & Hold and Overnight portfolios. What’s meant by this is, if the market was trending in a decline, the Intraday portfolio would tend to be the first of the three to reverse into a positive trend, followed usually by the Buy & Hold portfolio, and then the Overnight. For example, the Intraday’s current trailing 12-month return recently just returned to positive territory (January), while the other two portfolios are still reading negative, though now showing some improvement (indicative of 2022’s returns).

One could spend a lot of time analyzing what this means, though the shining takeaway, to us, is the benefit of the Buy & Hold portfolio. Not just as a way to capture both the intraday and overnight returns, but also with reduced trading costs and taxes, AND the peace of mind that there’s zero concern over the timing of buying and selling securities.

At Granite Wealth, not only do we look to align our clients’ portfolios with their goals and their risk tolerance, but we aim to educate them on what we are doing and why. It’s important to understand that there are investors who attempt to time the market, and there are investors who trade after hours to chase returns, though it’s critical to understanding where we can become efficient and emotionless investors as well.

When it comes to investing, we love efficiency, because it means you spend less time, money and energy trying to maximize your returns, and instead can spend more time on doing what it is that you love to do.