We still feel confident on our call of the markets bottom of October 12th, 2022.

Normally markets would see a consolidation period after the 10% rise from that bottom. Further, most 5% pullbacks do not lead to 10% “corrections” or drawdowns. In 2022 we experienced 8 such pullbacks. Since 1949, the S & P has averaged 3 per calendar year.

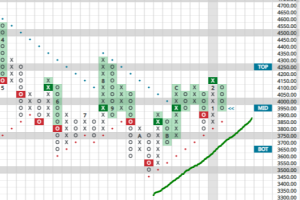

S & P 500

(April 2022 – February 2023)

How does that dovetail with Barry Ritholtz’s Big Picture call, that anecdotally, the markets tend to bottom in March? We wrote about market action in between earnings seasons here where post earnings reporting geopolitical events move into the spotlight, for better or worse: Trading Patterns I’ve Observed in 39 Years in the Business.

That backdrop looks horrifically frightening right now.

Could market action encompass both of these factors and now go into a consolidation of the gains since that October bottom?

We feel a 5% pullback during this in-between period resulting in an intermediate, higher bottom from October is increasingly likely.