Investors know that copper has been on a run in 2024, seeming to validate the Goldman Sachs thesis that says persistent undersupply of the metal is coming at the perfectly wrong time. As data center demand skyrockets to power AI and parts of the West move to electrify their grids, the red metal seems perfectly positioned. Indeed, the run thus far has been spectacular:

Having traded recently at over $5 per pound ($10,000/ton), copper is causing some investment banks to raise their price targets for the metal.

At the same time, AI agrees. What I mean is, we all saw the release of OpenAI’s latest iteration, ChatGPY-4o, this week. With yet another huge leap in the LLM’s performance, we decided to have a little fun and ask it to analyze copper’s outlook. Here was our simple prompt: “Please predict whether CPER stock will be higher or lower by the end of 2024.” CPER, by the way, is the copper ETF… more on that in a moment.

Here was ChatGPT-4o’s response:

The outlook for the United States Copper Index Fund (CPER) by the end of 2024 is cautiously optimistic, driven primarily by predictions in the copper market. Analysts generally anticipate an upward trend in copper prices due to factors such as supply disruptions, increasing demand from the renewable energy sector, and economic recovery in major markets like China.

Copper prices are projected to rise, with some forecasts suggesting significant gains through 2024. For instance, analysts expect copper prices to average around $8,602 per metric ton in 2024, up from current levels (SP Global). This potential increase in copper prices bodes well for CPER, which tracks the performance of copper futures.

However, as with any market prediction, these forecasts are subject to changes based on global economic conditions, geopolitical developments, and shifts in market dynamics. Thus, while the trend appears positive, investors should consider these variables when making investment decisions.

Overall, the CPER stock is likely to be higher by the end of 2024 if these positive trends in copper prices materialize.

The LLM almost sounds ready for a guest spot on TV! And it concurs with Goldman by being bullish on the metal.

Close obvservers will note that ChatGPT seems a little behind on the price, however. Copper is already well above the price levels it mentions, which is due to the fact that even the most recent version has a data cutoff of last October. Copper prices were significantly lower throughout 2023.

Regardless, both our current and future overlords, Goldman Sachs and ChatGPT, are bullish on copper as an investment theme. Should investors be chasing the latest rally, though? As Lee Corso would say: not so fast.

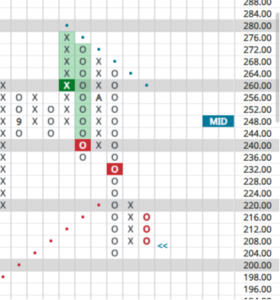

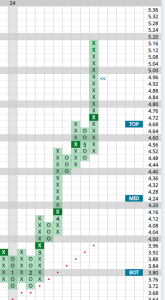

Let’s filter out the noise by looking at a Point & Figure chart of the CME copper contract:

This commodity is up on a stem with the latest double-top breakout at $4.72, which occured when it was already at the top of its expected trading band. Wait for a pull back to that break out point before even thinking about chasing here or, optimally, at $4.44, the first support level.

Remember, numbers within P&F charts represent months of the year. Since the first key triple-top breakout at $3.96 in March, copper is up over 25%! Hard to imagine how that sort of streak continues.

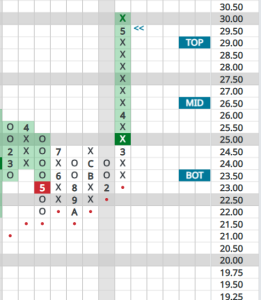

For stock market investors, a way to play the metal is via CPER, the exchange-traded fund. Let’s take a look at its chart:

This copper ETF has not experienced such a parabolic move as its underlying metal. However, because it is also short-term overextended, investors would be wise to wait for a pullback to at least the $26.50 range or better yet, the bottom of its trading range, $23.50. That said, looking to do some nibbling on such a pullback could make sense. The recent surge has brought into play some startling new upside price potential in the longer-term. For CPER, that target suggests $44.50, which after a pullback could be the ETF catching up to the move in metal itself.

In summary: as with any asset that has gone almost parabolic, it is wise not to chase copper too aggressively here. Longer term, however, charts suggest that both Goldman Sachs and ChatGPT-4o may be onto a clever secular theme here.