Here it comes… the old calls of, “Sell in May and go away.” Expect to hear this phrase trotted out with regularity by market pundits.

While this saying used to have merit, fully a year ago we debunked the idea that is still does, pointing out how it has lost all relevance over the past decade plus. Conversely, there are rotations that often take place in the supposedly “unfavorable” period. Key to this is sector rotation, as there is a wide divergence in performance between groups of stockss.

What are some highlights that prove the need to drill down into sectors?

Semiconductors, as one example, have been a pillar of strength over the last 5 years overall. However, this was the worst performing group in the seasonally “unfavorable” period of May-October last year. Also at the bottom of the list in recent years were commodities and materials, Oil and Oil Services, Steel and Media. At the top were Software, Insurance, Biotech and Aerospace.

Look at the charts of a few highlighted sector ETFs…

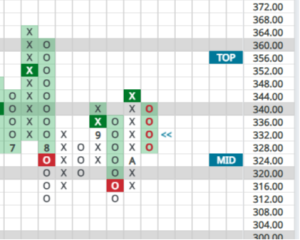

iShares Software – IGV

The chart above is noteworthy, as it appears to be forming a classic Point & Figure pattern called a Shakeout. Due to its positive overall action, we assume the recent reversal into a negative column of O’s and a double-bottom break at 82 are false since it has reversed back up into X’s. A triple-top upside breakout at 88 would complete the shakeout and suggest an upside target to at least 110.

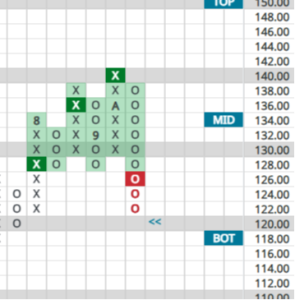

As you can see in the following chart of the software sector’s peformance in recent years, it is wise to approach IGV with an upside bias, even during the post-May period.

We recently wrote about 2 emerging sectors that warrant attention, Restaurants and Building Materials. Might they be the 2024 candidates for continued outperformance? The charts would suggest so, each with strong recent breakouts with room to run on the upside.

Here is the restaurant ETF…

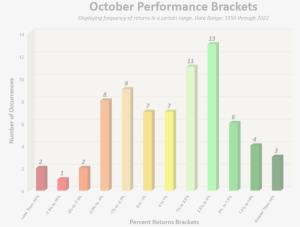

Van Eck Restaurant ETF – EATZ

After a meteoric rise, the sector finally reversed down into a column of O’s. We consider this normal consolidation after such a powerful rally, allowing interested buyers a better entry point in the near future.

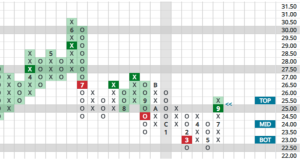

Invesco Building and Construction ETF – PBK

PBK is another exchange-traded fund that has seen a tremendous rally. Certainly, a pullback into a column of O’s after such a run shouldn’t surprise. What’s interesting is how the recent reversal back up into X’s looks at present. Because the prior rally was so huge, we would expect the need for more consolidation, which may result in a triangle pattern being formed. Triangles can end up being either positive or negative, but when a sector is above its bullish support line, we would expect such a formation to resolve to the upside. Bulls can look to patiently buy dips. The first yellow flag would occur should we see a double-bottom break at $66.

Our overall Election Year theme remains intact. Expect a mid-year consolidation, which may be close to completion, and an increase in upside momentum as we get into the July Q2 earnings reports. Should such a bullish outcome occur, we would expect stocks to continue to build momentum in the pre-election months.