We have been expecting a pause in the spring of this election year for some time. Historically, this has arrived in the February – March period. As growth stock managers, we are constantly on the lookout for under-the-radar growth stock opportunities. In such a sector rotation, will value stocks regain their leadership? We think not, but if this does occur, we expect it to be very short-term in duration.

Many are overweighted in the Magnificent Seven, of course. If you are looking to broaden out your growth holdings, consider these 2 micro sectors – Restaurants and Building Supplies.

Restaurants

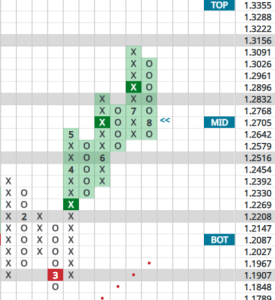

AdvisorShares Restaurant ETF – EATZ

This broad-based ETF holds a full range of companies from high-flyers to slow movers. The components of the ETF have experienced mixed results in 2024: Chipotle up 21%, Shake Shack up 41%, and Brinker International up 9%. Consider this broad-brush approach for a conservative sector play. EATZ is up 50% from the October bottom and currently above the top of its trading band. Wait for a slight pullback before committing to it. Potential price objective is the high $30’s.

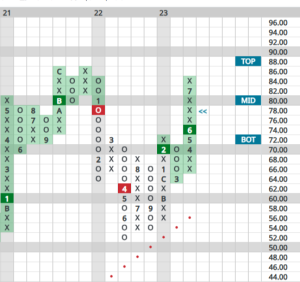

For an individual stock in this sector, consider Brinker International – EAT. Full disclosure, I own this personally.

Brinker International – EAT

Also up dramatically from the October bottom, it still has upside to the mid $70’s range.

Building Supplies

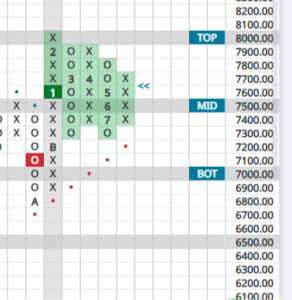

This sector is prone to wild price swings, mainly due to the homebuilders, which investors seem to be using as a proxy for when Federal Reserve interest rate cuts will hit. We prefer to sidestep the home builders and focus on building materials companies that have pricing power. The Invesco Building ETF – PKB has had quite a rise recently. We believe there is still upside.

Invesco Building ETF – PKB

Wait for a pullback here, optimally to the mid-point of its trading band in the $65 area.

AZEK Company Class A – AZEK

Potential price objective – $66

Bottom line:f you are looking for a better balance to a tech-heavy portfolio, consider these 2 growth sectors. Don’t fall for the very short-term head fake of value stocks.