Last week we wrote about sectors to consider in the March rebalancing period. We identified 2 sectors of growth stocks to consider, Restaurants — one day before Chipotle’s 50-1 split announcement — and Building Suppliers. Today, we want to drill down into the latter.

We favor the building materials companies over home builders as they a little farther removed from speculation regarding the next interest rate move by the Federal Reserve than are the homebuilders. As an aside, against a secular backdrop of a substantial shortage of housing in many parts of the country, we don’t agree with the consensus view that builders are beholden to the Fed. That said, we can’t control others’ perceptions, which makes the building materials stocks worth looking at as perhaps less dependent on the Fed.

Anyone who is undergoing construction knows that the prices of materials and construction labor remain extremely elevated. This line item is blowing up project budgets.

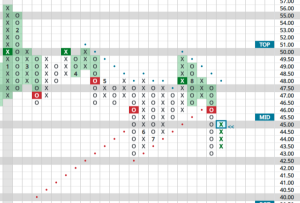

Markets, too, are aware of this reality. Take a look at the performance chart of stocks in this favorable sub-sector:

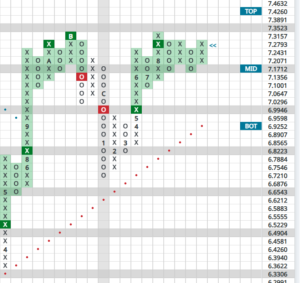

Interestingly, the above chart looks a lot different than the next one, which is a look at the reported earnings surprises vs. analysts’ estimates:

Despite the pricing power currently enjoyed by materials suppliers, last quarter’s earnings were a mixed bag. Meanwhile, the forward guidance from some of these companies may be reflecting uncertainty as they, too, are perhaps overly focused on the Fed.

From a technical perspecitve, despite the outperformance of the building materials sector in recent months, the immediate trend is likely to remain intact for the balance of 2024. Select names can be considered for accumulation.

Prospective clients can contact us to discuss details and to learn more about our approach.