The Generational Bottom was 15 years ago last week.

Even 5 years can be a long time for younger investors or retirees but can go by in a flash. The devastating Great Recession Bear Market crash seems to have burned into investors’ minds, the bad memories they bring stick around much longer than bull market periods.

As NASDAQ Dorsey Wright reminds this morning:

Do you recall CNBC’s Jim Cramer and his numerous rants during the time? Here’s one that possibly still exists in investors’ mind.

“On the TODAY show on October 6, 2008, at which point the S&P 500 was already down more than 32% from its 2007 peak, Jim Cramer said “Whatever money you may need for the next five years, please take it out of the stock market right now, this week. I do not believe that you should risk those assets in the stock market right now.” Investors who followed Cramer’s advice avoided another 25% of the downside in equities, but how many became so fearful that they never reentered the market and missed one of the greatest bull markets in history?

Retrospectively, it’s easy to see teh harm done by cashing everything out.

Oh, but the headlines were scary…

April of this year will mark another the anniversary of yet another important bottom – four years since the 2020 Covid-19 crash. That wipeout shook still more out of the market.

At any point in time, headlines can tell a frightening tale. But have the day’s worrisome stories typically meant it made sense to wait for all clear signals before committing funds to the stock market?

If you wait for such a time, the day will never come and you’ll surely miss the bus.

Whether you are already in retirement (where you might expect to live another 20 years) or trying to save enough for your first house, be cognizant of your true holding period.

Accumulating wealth is a long game. Disregard the get rich quick mentality of today. Ditto with the casino mentality that makes finance appear easy.

And while you’re at it, learn to tune out most headlines and even embrace a little volatility.

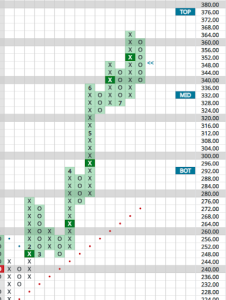

It would have been great to sell stocks right before the 2008-2009 bear market, then to buy back in at the lows. Since few did, however, living through the pain – and even committing more dollars during the drawdown – was a much better play than going all-cash and rushing to the exits.