Here we are, between earnings seasons – another period in which investors take a wait and see attitude and often expect the market to pause or even pull back some. Indeed, even I recently suggested such a pause might occur soon.

Not only was the market extended on a technical basis, these times between earnings tend to be when other headlines get front row seats: geopolitics, domestic politics, doomsdayers, etc.

A break in the Magnificent Seven could be in the cards; watch for a short-term return to value investing in the context of a sector rotation. Market participants may well take refuge in the value stocks that have had a much more muted participation in the rally since October. I expect such action will be short term in nature, however.

If a small pullback were to take place, where are the near-term areas of support?

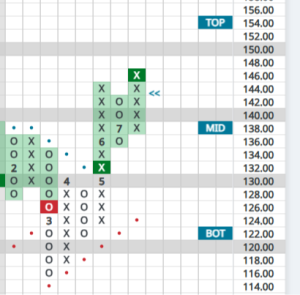

S&P 500

For now, the S&P 500 remains in a rising column of Xs, although it is extended and near the top of its expected trading range. Initial support could seen near 4900, the middle of its trading band.

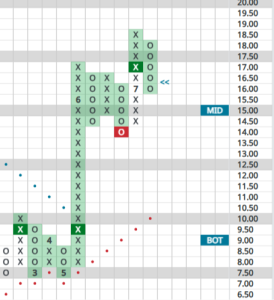

NASDAQ

Unlike the S&P 500, the tech-heavy NASDAQ has reversed into a declining column of O’s. Initial support should appear in the 15800 range, then around the middle of the trading band at 15500.

Triple Witching

Odds are very good that this week’s Triple Witching will lead to an increase in volatility as Friday approaches. Take advantage of this action to take small rebalancing actions if opportunities present themselves in names you’ve been watching.

Complicating my short-term pullback thesis slightly is that Stock Trader’s Almanac reminds us March Triple Witching tends to have a positive outcome (particularly in recent years). Looking out to the end of the month, fund managers will engage in window dressing, adding positions to winning positions. There’s no end to the factors to keep in mind.

Finally, remember to ignore the idea that whichever way the market moves during triple witching week, it will unwind the following week. We busted that myth last year.

For now, simply keep in mind that we’re in a week that typically brings increased volatility, against a backdrop of an extended market that needs to take a breath.

Next week, I’ll write more on the action of value vs. growth and emerging sectors in which to consider new positions, including the Building Materials / Suppliers sector and The Restaurant sector.