We have recently written on the international markets and to what extent they should be featured in your stock portfolio. Today we focus on China.

It’s well known that despite China’s aggressive international infrastructure initiatives, highlighted by Belt and Road, its problems center around the massive debt issues that are being exposed in the country’s real estate sector. Market strategists and economists paint a bleak picture of China’s prospects and many speculate they only path away from this reliance is a pivot to technology — ghost cities replaced by EV factories — a process which does seem to be underway.

Western analysts have consistently underestimated the ability of Beijing’s economic interventions — such as subsidies, state-directed investments and other non-market incentives— to boost new industries and power innovation. Xi’s restructuring of China’s economy toward high-tech industries could eventually pull the economy out of the doldrums but this is no overnight solution, particularly due to the sheer scope of its property market challenges.

Cross-currents abound. China’s increasingly successful electric vehicle sector, initially heavily subsidized, is an ongoing success, while the safety and security of U.S. supply chains and the production shift toward other Asian countries like Vietnam presents a headwind. To answer this, China is leading the highly visible BRICS initiative while also strengthening its grip on the South China Sea.

Will there be a slower growth contagion?

With the mixed big-picture backdrop described above, where does growth go next? Could China export deflation and recession? It’s possible that if global financial conditions tighten, it could create a domino effect on GDP growth elsewhere. In a recent interview with CNBC, Philadelphia Fed President Patrick Harker expressed uncertainty regarding how the China slowdown will affect the U.S. economy. However, the sheer size of the Chinese economy — now effectively 20% of global GDP — means any slowdown there will go unnoticed by other major economies. We suspect the effects on real GDP growth in the United States could be minor, in part because American banks’ exposure to China is limited, but it won’t be nil.

What about financial contagion?

Despite its ongoing balance sheet adjustment away from the U.S. Dollar, China remains holder of 13% of US treasuries (now at $867 billion), the lowest level since 2016. Thus, the country is still beholden a significant creditor to the U.S. Conversely, foreign holders of Chinese debt is currently just 2.5% of China’s interbank bonds, according to Reuters. Other foreign banks’ exposure to China is limited, while American banks have about $20 billion in exposure to China, a tiny amount for a system with nearly $23 trillion in assets. At roughly $60 billion each, the Japanese and Eurozone banking systems have more exposure, but the amounts are still manageable. Given these figures plus the government’s willingness to aggressively intervene in its economy, we suspect the odds of a Chinese financial contagion sparking a global recession are much lower than those of a growth slowdown becoming problematic.

What do the charts say?

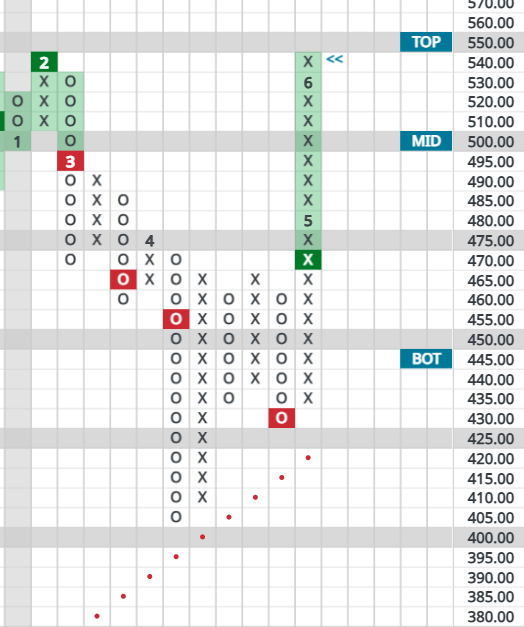

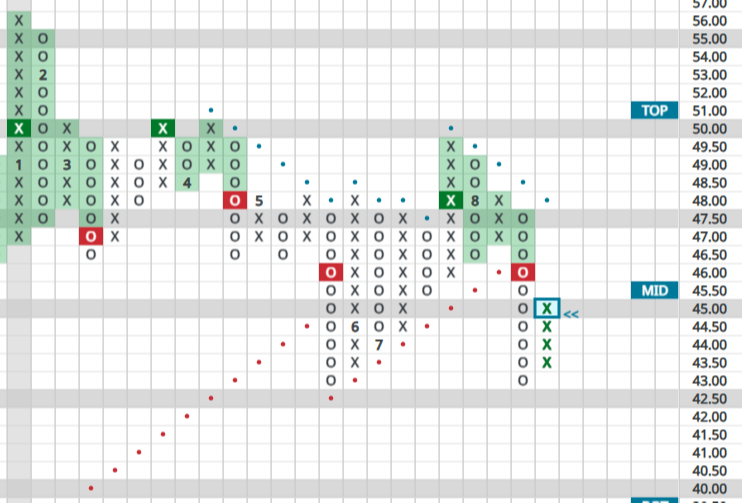

As can be seen below, in the iShares MSCI China ETF, Chinese stocks have broken support levels twice in 2023 after numerous attempts to regain the January high of 55. Even the recent rally (column of X’s) has done nothing yet to flip the technical picture to positive, while significant overhead resistance also remains. Caution is warranted.

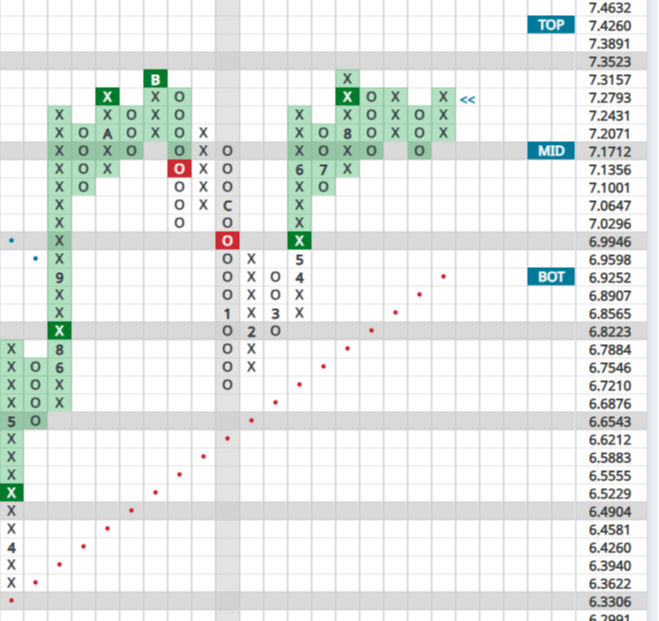

When looking at the currency, in this case the US $ relative the Yuan, can see in the chart below that the U.S. Dollar continues to show strength vs. the Yuan in 2023. The pricing band is a relatively small one but a break by the dollar to new highs could be a sign that risks of financial contagion out of China are higher than we perceive them to be at present.

In conclusion, the fundamental picture out of China is a mixed bag, with positive domestic and international initiatives being offset by substantial headwinds. Technically, the charts tell us that it is proper to be cautious regarding long-term exposure to China, with both the currency and the country’s stock market suggesting more weakness lies ahead. The next moves by Xi could be key to how the dominoes will fall for his country. At present, it looks to us as though any governmental interventions will have to be quite big to move the needle in a bullish Chinese direction.