Commodity indices have been traditionally weighted towards energy, precious metals and agriculture. Surprisingly, when you look at today’s components, one finds a large percentage of Treasury holdings. Take DBC – Invesco. Its largest is AGPXX – Short Term Government Trust holdings are 25.91%, US T-bills at 14.16%. Only when you get past these unusual holdings does energy appear. Crude and natural gas comprise 14%. Precious metals are 9%. Agriculture clocks in at 9%.

Invesco DB Commodity Tracking Index – DBC

Seasonally, energy has made moves in Q3 historically. Many of the reasons for this are due to supply concerns (impacted by hurricanes) and looming winter heating demands. Current geopolitical issues have led to agriculture shortages in food and fertilizers, as well.

How does the dollar impact this?

Traditionally, commodities have benefitted the most from a weak US Dollar, of course. This year has seen the ICE US Dollar Index Spot (DX/Y) decline to the 99.5 range from last year’s 114.5 September high. Recently, however, the $ Spot has experienced an upside breakout with a potential significant triple top breach at 106. This would change Spot’s trend from negative to positive.

Could an upside breakout in the Dollar mean lower prices for Crude?

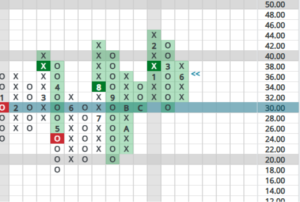

Isolating on oil by getting away from the index I highlighted above, Crude looks like this on the chart:

Crude Oil Continuous C/L

With the November print of $93 straight ahead, there exists some meaningful overhead resistance nearby for Crude, meaning a short-term pullback could be seen. If the $94 level is breached, a price objective all the way up to $115 area looks possible, believe it or not.

Will Crude follow the rule that a stock that “trades at $90 will go to $100?”

Our view is that if Crude can push through the overhead supply at $94, there are technical grounds to support a move to $100 and beyond. That said, oil is already extended and near the top of its expected trading band, so any upside breakout could well be a “blowoff” top for Crude.

While elevated oil prices will continue to show in core CPI, investors are by no means ignoring Crude at this point – meaning it may already be mostly baked into the stock market cake.

In conclusion, Crude’s posture is still positive. However, because it is both extended and well-followed at present, any reactions to higher oil prices is likely to be fleeting as the seasonally favorable period arrives for stocks.

Watch the $94 level: a failure by Crude there could bring near-term relief to stocks. A move above could bring a sharp rally in oil and likely a top. Stocks would suffer, short-term, but it could set them up for a nicer entry point as we are still constructive on the market. Oil-related action should resolve itself quickly, that’s the good news.