“Sell on Rosh Hashannah Buy on Yom Kippur,” that’s what the stock market adage says. How might this advice shape up in 2023?

Well, now that the high holy days have passed, the first part of that old saying has indeed come true; the S&P 500 was down 2.5% From Rosh Hashanah to Yom Kippur (September 15th – 25th).

The drawdown wasn’t earth shattering, but we certainly seemed to get a news cycle full of negative headlines and, taking into account the small percentage of trading days the old saying covers, it’s enough to continue paying attention to this lore.

So, after Yom Kippur and with an increasingly pessimistic crowd on Wall Street, what comes next?

To answer this question, let’s keep in mind another general truism: although September is statistically the worst month for stocks, October is generally the bear killer.

According to NASDAQ Dorsey Wright “Still, the S&P 500 (SPX) has had more double-digit gains in October than it has double-digit losses since 1950. In fact, October is often referred to as the ‘bear killer,’ as its end ushers in the beginning of the seasonally strong six months of the year. The most recent example we have is last year, 2022, when the S&P 500 bottomed out in October, and that area is still referenced today as a key area of support.”

Rebalancing

In the 4th quarter, rebalancing takes place on a large scale. Many institutional managers, including mutual funds, reconcile their 10-month profits and losses in preparation for year-end distributions. In addition, firms make forward-looking asset allocation decisions. This year may be exceptionally volatile as the bond market experiences wild swings in price and yield while grappling with stubborn inflation readings. This, in turn influences Quants’ outlook for stocks. Best of all, the reliable stock market months of November and December lie just ahead.

Despite how worrying some of the fundamental data has been looking in recent weeks, slow down and remember this: the S&P 500 is down just 1% in the the 3rd quarter. In the meantime, all that has really happened is that the 2nd quarter’s overbought condition has been worked off.

This set up is consistent with the pause that refreshes that we wrote about in our July 6th Q3 Market Outlook and again on September 5th (Any September Weakness likely is a Healthy Pause that Refreshes).

OTCHILO

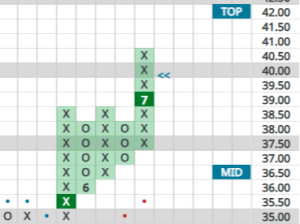

While long term technical indicators have pulled back, the bullish trend line from October 2022 remains intact. Short term indicators are at oversold levels (in the case of the OTC universe, deeply oversold).

More specifically, let’s highlight just one indicator, the NASDAQ HiLo index (pictured above). While it is still in a declining column of O’s, with fewer than 20% of OTC stocks marking new highs, it is back to the extremely oversold levels seen in March — a 15% rally ensued. Watch for reversals up in short-term indicators like these for an opportunity to scale into new positions.

In short, the pause that refreshes is close to its end.