XLF is moving higher as the year-long – scratch that, two-year – stock market rally broadens (much to the chagrin of the perma-bears, I’ll bet).

As growth stock managers, we generally have not included banks in our portfolios. Value managers love them but we do not feel they often represent a profile of the growth economy. More recently, we have searched for other sectors behind technology that fit our growth parameters. As a result, we have been focusing on homebuilders, construction materials and specialty finance.

Under the hood, however, XLF is an exchange-traded fund that tells a story of the financial subsectors including insurance, investment managers and specialty finance. Non-bank top holdings are names like Berkshire Hathaway, Mastercard, S & P Global, Goldman Sachs and more.

What shape are the charts of these companies, and do they support the broadening out of market breadth?

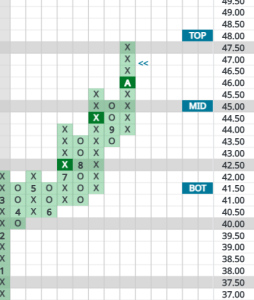

XLF – Financial Select Spider

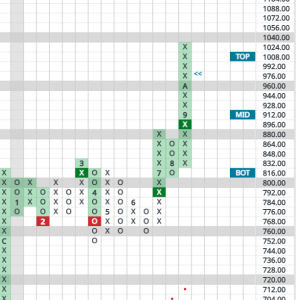

One cannot complain about market narrowness as XLF has fully participated in 2024’s rally. It is up 25.40% and has made a healthy string of higher highs (columns of Xs) and higher lows (Os) since the Spring:

Looking under the hood of this ETF, do any of its top holdings offer attracted entry points for interested investors? Let’s take a look from a purely technical perspective.

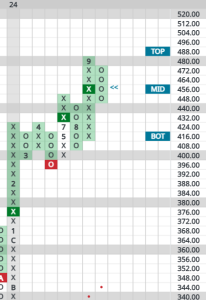

BRK.B Berkshire Hathaway

Warren’s “baby” stock. Its earnings are derived from the company’s extensive insurance operations and investment portfolio. No surprise with it’s 29.3% year to date returns, but a recent dip has relieved a short-term extended condition and could offer a better possible entry point than six weeks ago. Buyers could nibble here, with a thought of adding more should the stock make its way to the low 400s – a second chance that might not materialize.

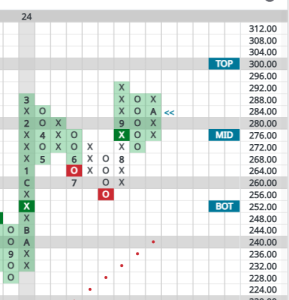

V – Visa

The coudy interest rate environment of 2024 and concerns about the consumer no doubt is a factored into this stock’s muted 9.37% y-t-d– return. In fact, even that gain reversed what had been a down year until investors became convinced a rate cut from the Fed would finally materialize. Remember, on our Point & Figure charts, numbers represent months (with A, B and C representing Oct-Dec). Below, you can see the violent reversal upward in late July. With the stock again moving higher and nearing the top of its expected short-term trading range, this isn’t a name we would be piling into at the moment.

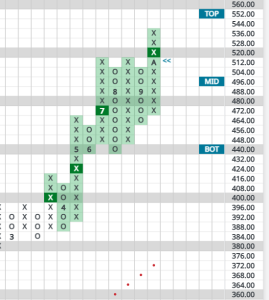

GS – Goldman Sachs

As many investors know, Goldman reported earnings a few days ago and strong trading and M&A profits boosted results. Congratulations to holders on their 34.5% gain y-t-d but at the moment, it’s hard to suggest an entry point and viable stop-losses points are a little too far below for our liking.

BLK – Blackrock

Fully participating in the broadening, but currently extended in its trading band, let this back and fill before committing.

With this brief look at the technical conditions of some of these popular financial services names, what are some quick takeaways?

First, the rally is broadening out, contrary to the ad nauseum outcry from those who say it’s only the magnificent seven stocks that are carrying this market.

Second, this moment is a tricky one for figuring out decent entry points in many financial services names. Because most have reacted positively already to the first Federal Reserve interest rate cut (and the expectation of more to come), patience and keeping an eye out for pullbacks would be our overarching advice in this varied sector.

Finally, not all financials should be grouped together with traditional banks as merely a value play. Diving a little deeper, growth opportunities abound beyond tech.