The S&P 500 has fallen into official correction mode, 10% on the nose from its intraday high of 6101 to 5490. While we have long thought the 10% correction and 20% bear market characterizations as very arbitrary, they can impact what investors say and do. Around here, we always try to prevent our clients doing the wrong thing at the wrong time – like going to all cash near market bottoms.

Today, we present the factors for the Bear and Bull case. You decide for yourself which odds favor your portfolio.

The Case for Further Downside

Recession Risk

Odds have increased that the economy will slip into a recession, as consumer sentiment and business confidence have fallen. Bond investors and speculators have cried the recession wolf for years and have been far off the mark. Will they get it right this time?

Uncertainty Risk

How can CEO’s and CFO’s plan capex budgets with tariffs looming?

Earnings Hit

Analysts have been lowering earnings estimates at the greatest clip since 2019. With the current uncertainty, expect this trend to continue.

Lack of Bullish catalyst

What event will signal the bottom is in and a rebound is underway? What will have a lasting impact beyond knee jerk reactions as the narrative changes daily? Seemingly nothing on the horizon can reverse the drawdown.

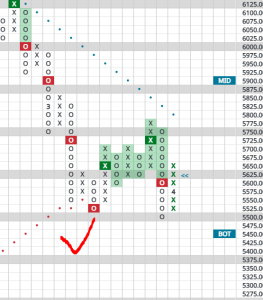

Technicals

The S & P’s short-term trend has broken down:

Ditto for the Mag 7:

Bears will take a look at those trendlines and conclude that the bull run is over for both the broad index and its biggest names within.

The Case that a Bottom is Near

The first 100 days of new administration are ending

The honeymoon trial balloon period is coming to a close. Historically, the first 100 days of a new administration sees its policy proposals floating about. These trial balloons can be quite disruptive and audacious, but they mellow as the chances of them becoming legislation become clearer.

History of Year 1 Q1 of Presidential Cycle

The first quarter of Year 1 of the Presidential cycle tends to be quite volatile, according to Jeffrey Hirsh of Stock Trader’s Almanac. In fact, there is a decent track record over the last 20 years documenting this. In the following quarters, markets tend to rebound.

Interest Rates have fallen

Little noticed by many investors is that he 10-year bond now sits at 4.15%, down mightily from 4.85% in January. Might this boost the housing market? The rise in rates hit the real estate market hard but had little effect on overall economic growth.

Earnings are Coming

The period in between earning reports has seen investors focus on geopolitical events while distracting attention from the most important factor in stocks: their earnings. Analysts will employ more guesswork in their estimates compared to past years as the tariff effects are unknowable at this point. Expect companies to sandbag estimates more regularly, meaning the recent round of earnings revisions may be too bearish.

Sentiment is historically negative

Headlines are gloomy. The AAII Bearish Sentiment hit a lofty 61% recently. Readings like this have been solid contrarian indicators in the past. Meanwhile, the ‘Magazine Cover Indicator’ is on full display.

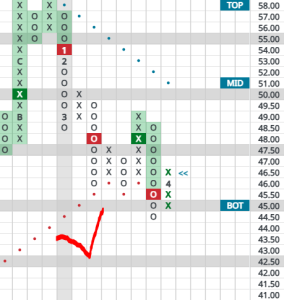

Short-term Technicals are washed out

The HILO index recently made a higher bottom and is thus gets closer to improving to Bull Confirmed status, which would occur if the next column of X’s exceeds the one before it. Please see my commentary from last week regarding what a healthy bottom in this indicator would look like.

At the same time, the % of stocks above their Ten Week (50 Day) Moving Average bounced off their recent lows (matching those of November, December and January). Like the HILO, this short-term gauge could soon improve to Bull Confirmed Status from the current Bull Alert.

When these two indicators reverse into Bull Confirmed from such low levels, investors should take notice.

Maintaining a generally bullish posture toward the market is generally the winning view to hold. Maybe things are about to fall apart but because such moments in history are rare, I do actively look for green shoots and suspect we’ve seen the worst of the selloff.

That said, there is plenty for investors to argue about at present. Bull or bear: where do you stand today?