Jim Cramer often says, “own it, don’t trade it” for stocks that he deems core holdings and should be held for years. We employ a similar strategy in our portfolios.

It has become more difficult in the last few years to adhere to this principle, when knee-jerk selloffs can arrive frequently for a variety of reasons. My favorite is when revenues and earnings come in above expectations but forward guidance disappoints.

Investors pile into a stock just before the earnings release (or take an option position on the stock) and take the forward “guidance” as set in stone without remembering that C-suite leaders have a vested interest in sandbagging such projections, making it easier to clear that lowered bar next quarter.

While we’re at it, let’s add in triple and quadruple witching option expiration weeks, where volatility can increase dramatically. And then there’s the old fallback: the “scary” level of 10-year bond yields, where so-called “bond vigilantes” get played again and again.

The technology sector has experienced a wild ride, set off in part by the DeepSeek announcement. As a result, let’s look at the action of 2 core holdings we own, Nvidia and Amazon.

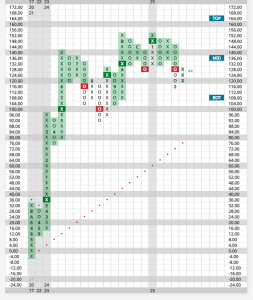

Nvidia (NVDA) has given numerous sell signal over the period covered by the following chart, 2017 to 2025:

In the bottom left corner, you see the column of X’s (representing a rising stock) that peaked at $32. Next, a column of O’s (declining) that took the stock down to $12…. a 62% decline! It took some time, but when the stock was able to get back in up gear is smashed through the old high and ran to $96, an 8-bagger from the washed-out bottom.

This pattern repeats in 2024, when the stock peaked at $140 and had a 34% drawdown to $92. The most recent peaks have been at $152 in October of 2024 and again in January 2025. The 23% may still be playing out, but the weight of evidence tells me yet another rebound is next for Nvidia.

How about Amazon?

The online giant just released earnings last; earnings per share projections and just met revenue estimates. The stock has sold off mildly because… you guessed it: “soft forward guidance!

It looks like sandbagging at its best. This did not sit well with the knee-jerk crowd. Maybe they swiftly dismissed the future return potential on the massive capex expenditure outlined during the call?

The conference call with Andy Jassy told a different story, as highlighted in this article excerpt:

Amazon’s profit is suddenly going through the roof, fueling CEO Andy Jassy’s $100 billion AI spending spree to fight Google and Microsoft

Jassy told analysts on an earnings call Thursday that Amazon will spend around $100 billion or more on capital expenses in 2025, up at least 20% from 2024. The “vast majority” of this year’s capex will go toward supporting Amazon’s broad and deep investments into artificial intelligence infrastructure as the tech giant competes for what Jassy called “probably the biggest technology shift and opportunity since the internet.”

For much of Amazon’s early history, investors and competitors knocked the online retailer for its seeming inability to generate profits. Even as recently as 2014, just a decade ago, the tech giant was unprofitable. But after posting a record-breaking $20 billion in profits during the fourth quarter of 2024 alone, almost double its $10.6 billion from the same quarter the prior year, Amazon is once again looking like the version of itself that many of its rivals should fear. And with that profit engine revved up and feeding an enormous cash buffer, Amazon CEO Andy Jassy is doubling down in the industry’s AI infrastructure arms race

Source: https://finance.yahoo.com/news/amazon-profit-suddenly-going-roof-031915901.html

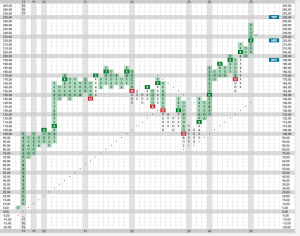

Over time, Amazon’s stock (AMZN) has had its own share of deep sell-offs, like the post-split decline that saw it fall by more than half, from $185 to $85. That changed in 2024, of course, when it again met its all-time high (to that point) of $185, paused and corrected mildly, then started another leg up to new far higher all-time highs. That’s where it sits today.

Know your holding period and keep reminding yourself of your portfolio’s core holdings. If you can’t come up with a very good reason to sell, like the kids need downpayment funds for their first house, don’t be so quick to let go of these few, special holdings.

Take a page from the legendary Ron Baron, who regularly appears on CNBC to discuss his strategy and was barbecued for his long-term holding period for Tesla (TSLA), a big reason his net worth stands at $6.5 billion today.

Maybe you won’t see your own net worth climb into the billions, but with the courage and conviction to stay with special companies and leaders over very long periods, your net worth can indeed surpass your wildest expectations.