Ed Yardeni, as I explained in Part 1 and Part II of this series, has a pretty optimistic view of the current decade. He calls it the “Roaring 2020s” and I’m inclined to agree with him.

Of the five key pillars that support Yardeni’s bullish outlook, one that some investors might struggle to believe focuses on the Federal Reserve’s interest rate policy.

Here’s the gist: Yardeni argues that if the last rate hiking cycle didn’t push the economy into a recession, that’s a really good sign. And the possibility of more rate cuts in the future? Well, that just throws more fuel on the fire.

This may sound simplistic at first, but if someone had told you prior to the last rate-hiking cycle that rates would rise from effectively 0% to 5%, you would have virtually guaranteed that a recession would result.

The fact that it didn’t strikes me as validation that we’re in the midst of another technological productivity boom that will only be easy to see in retrospect, as described in more detail in my first two essays in this series.

Further, I have a different take on inflation, one that at first glance might seem simplistic, as well.

Yes, prices have remained sticky, which has caused the Fed to slow down on promised interest rate cuts and has revived the bogeyman of entrenched inflation.

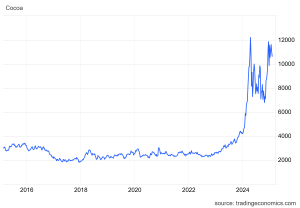

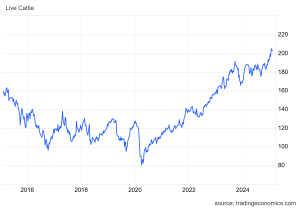

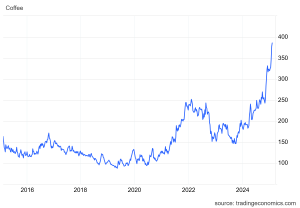

I, however, see things a little differently. Currently, key inputs like eggs, cattle, coffee, cocoa and poultry are not just at or near all-time highs, most of them have gone parabolic in their recent rises and are at levels few could have previously imagined.

Just look at these 10-year charts and note how frenzied the price increases have been over just the past year or two:

Cocoa

Cattle

Coffee

Orange Juice

Set aside whether these trajectories are likely to continue (they are not). Are their current levels even sustainable? The history of commodity prices and their violent reversions to trend suggests otherwise.

The increases in such core inputs have certainly put great pressure on consumers, particularly lower-income Americans, but no one can look at these trends and think their trajectories are likely to continue.

As a chart-watcher, in fact, I see them as stretched in such a way that makes them all susceptible to dramatic mean reversions to the downside. Should that occur, the economy will breathe a huge sigh of relief and Federal Reserve interest rate policy can remain the bullish pillar Yardeni and I expect it to be.

Of course, there are always risks and uncertainties in the market, but I believe that Yardeni’s focus on the Fed’s interest rate policy is an important one. If commodities prices finally break and the Fed is able to support the economy with accommodative policies, it could very well pave the way for a continuation of this roaring bull market in the years to come.