In the first part of our series on the Magnificent 7 stocks following their earnings reports, we wrote a longer-form, focused take on Amazon (AMZN).

In part II of this post-earnings review of the technical conditions of these highflyers, we take a different approach and whip through Apple (AAPL), Google (GOOGL), Meta (META), Microsoft (MSFT) and Tesla (TSLA). Enjoy!

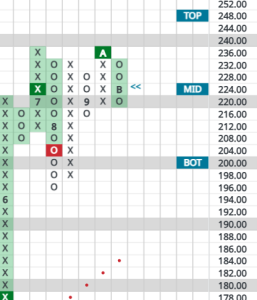

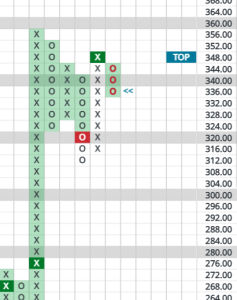

AAPL

A very muted reaction to their earnings when compared to dramatic post-earnings moves we’ve seen when Apple has reported over the past year. The stock wanted to make a new all-time high at $240 but could not muster enough buyers to get there. A descending column (O’s) that breaks a double-bottom by hitting $212 would be the first minor negative, while an upside reversal and break to new highs would fuel further gains. Beauty is in the eye of the beholder here, but we maintain a bullish stance, particularly with easy visible stops available nearby.

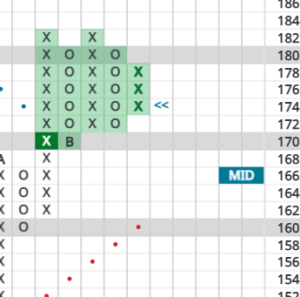

GOOGL

Blowout upside earnings took GOOGL from $160 to $182. After consolidating that move it has revisited the $182 print but has not been able to push through that line in the sand. I do see a possible bullish triangle pattern lining up that would be complete with a print at $184.

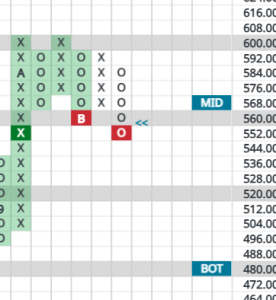

META

The knee-jerk reaction to META’s earnings was negative. The feeling was their forward-looking capex to fund its AI products is going to drag on growth rates and could undo the excitement of META optimizing its growth plans. Support was breached at $568 and $560. Further downside risk could put the stock closer to $500 before it bottoms. Other Mag 7 names look more attractive here, technically.

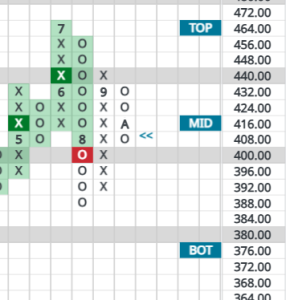

MSFT

Since the release of its late October earnings, MSFT has consolidated right where one would expect: in the middle of its trading band at $416. Stocks in strong uptrends tend to work off overbought conditions by simply marking time as its moving average catches up to the absolute price. Coupled with the company’s overwhelmingly positive fundamental position in the market and there’s no reason to move off a bullish posture toward this stock.

TSLA

TSLA has become a darling again after spending quite a bit of time as a Mag 7 dog. In addition to a post-election afterglow, we view the earnings report as the main catalyst that sent it from the $240 range to $350. Currently it’s consolidating that move near the top of its trading band. This is not optimal, as we like to see this occur near the midpoint on its trading band. Certainly, the stock is extended here. Anyone wanting to buy shares for the first time would be wise to exercise patience.

Tomorrow, we round out this Mag 7 review with a focused look at Nvidia and its earnings release. Stay tuned!