For several years now, I’ve been one of the ~50 global portfolio managers that Reuters calls for its semi-annual market forecast.

The reporters there take the combined predictions of the group and come up with an consensus “estimate” based on the average predictions of where market averages will be in 6, 12 and 18 months. While we typically shy away from the prediction business, we do participate in this one.

The article with our predictions came out in late November but I thought perhaps I should share it since post-election years can be action-packed in the stock market.

What I’ve done below is share the answers I provided to Reuters in its simple survey, along with the consensus prediction they report. Unfortunately, the article only discusses the year-end average number instead of all three we provide.

It’s too bad in this case, because those timeframes actually make things a bit interesting. Hopefully, you’ll see what I mean below and will find it useful as food for thought.

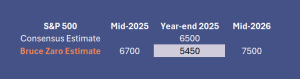

First, here’s a look at my predictions vs. the group:

You can see that on the one hand, my year-end prediction is much more “bearish” than the group… I’ll have more on why I put the word bearish in parentheses in a minute.

On the other hand, however, in the short term I am much more optimistic than the group, with a target that’s actually higher than their year-end figure. Why?

First, the Santa Claus rally is only a couple weeks old, and it kicks off what has historically been the most favorable 6-month period for stocks over the past century. Post-election years tend to participate in this rallying phase in the first half.

However, there is often a darker side to markets during the latter part of such years. It is early in a new administration that politicians are least worried about reelection (something this president-elect doesn’t have to think about), meaning they’re most willing to deliver tough policy medicine during this time.

The Trump administration has some policy proposals that the market deems as bullish, for sure, but there are others (like tariffs) that are not perceived this way. Which policies get passed, and when, could have quite an impact on investors.

Post-election year rallies often tend to fizzle in the 2nd half, which is why my prediction says we will see a continuation of this rally from here, perhaps another 10% higher, then the first meaningful correction since our aggressively bullish call in October 2022 (when the Dow was at roughly 30,000). If you’ve never read that article, by the way, it gives a glimpse of how we approach markets… that happened to be a very fearful time, one which presented an oversold buying opportunity of the type that doesn’t come around very often.

This is why I put the word “bearish” in quotes up above in this post. We have remained firmly bullish on stocks since – and remain so, despite our concern we’ll finally get a measurable pullback in 2025.

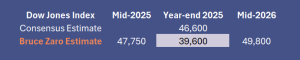

While we’re at it, here’s a look at our predictions vs. the group for the Dow Jones Industrial Average:

Again, you can see that I think next year’s returns will be front-end loaded.

But this is also why I was sure to include my mid-year 2026 prediction: it shows that we remain bullish on stocks in the long run, which means we plan to be shoppers if a correction does materialize in coming months.

In addition to the predictions we submit in writing, Reuters asks for our level of confidence in these predictions. A couple of their sample questions follow, plus my responses:

Q: How likely is a correction of 10% or more in the S&P 500 early next year (highly likely / likely / unlikely / highly unlikely)?

A: Unlikely, because of seasonality. However, given that post-election years tend to be difficult, a correction later in the year is likely.

Q: What is the reasoning behind your S&P targets?

A: Fundamentally, earnings will be strong. Technically, upside momentum is a tailwind.

As you can see, we’re not drafting the Magna Carta in providing these responses. I do enjoy participating, however, because it provides another opportunity to focus the mind and think deeply about how things might play out – a valuable exercise when actively managing client assets.

It should be noted, I could be wrong. I don’t frankly worry about that too much because these are point-in-time surveys but in markets, things change. If technical conditions break down earlier than expected, we anticipate being able to recognize this and we will deal with it based on client risk profiles.

So, if a correction does hit in the first half of the year, then my mid-year and year-end estimates will look precisely backwards and my colleagues will look right next year. However, if I’m correct about when a correction lands (if it does), then I’ll get the bragging rights. These possible outcomes seem pretty clear given the distinct differences in our predictions.

And that’s the fun in it for me.

For you, hopefully there’s some value in this little peek behind the curtain!