Back some time ago, the firm I was with specialized in several rather esoteric, under-covered areas of global markets. One such focus was maritime shipping – the firm even helped bring public the first shipping ETF in partnership with what was then Claymore Funds (NYSE SEA at the time), which has since been acquired.

We rang the bell at the NYSE and everything seemed great; this was August of 2008, the Great Recession was only in its infancy and we had just passed the peak of a multi-year rally in shippers. Of course the market wanted this fund!

Recession Predictor?

Back then, the Baltic Dry Index was viewed as a key indicator of economic activity. Even if that was true then, which is questionable, is it still the case today?

Last week’s release of stronger-than-expected 4th quarter GDP data has left only the perma-bears calling for recession. Let’s see if the Baltic Dry Index can help provide any insights on the topic.

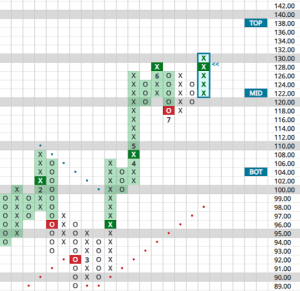

Below is the chart of this index going back to 2004:

Remember: in Point & Figure charts, numbers represent months. Looking back at 2008, then, we see the index peaked earlier that same year. Indeed, the Baltic Dry had reversed into a declining column of O’s more than 2 months prior to the ETF’s launch!

Most economists now consider the Great Recession as having started in December of 2007, which calls into question the idea of this shipping index as a leading indicator.

How about today?

Fast forward to the recent action for the Index. Those who still cling to this index as a predictor or economic growth would have said the sharp drop-off from the October 2021 peak of 5400 to the grizzly bottom of 600 in February of 2022 was predicting recession. Indeed, many were saying this very thing, even well after that trough was hit.

In truth, shipping rates are far too complicated to be relied on for their economic powers of prediction.

Today we see Red Sea turmoil. Back in that 2021-22 timeframe, the post-Covid stimulus was working its way through, causing the inflation spike. Shutdowns of manufacturing and port facilities ensued. Consumers, flush with government checks, chased scarce goods and bid up prices. Corporations, eager to protect their profit margins posted sticky price increases. Meanwhile, newbuilds are seldom discussed nor factored into the outlook for the Baltic Dry.

Simply put: the BDI has never been the accurate economic prognosticator its adherents claim. Truly, one would think the Great Recession lasted over a decade by looking at the chart above!

Instead of the Baltic Dry, look to a better predictor of economic outcomes: the stock market itself. With the S&P 500 logging a positive January, the stocks remain in a bull market and investors are collectively predicting continued strength in the economy, just as we have been writing for months.

More details can be found in our 2024 full-year outlook.

In summary, shy away from arcane indicators being touted as surefire predictors of economic outcomes. The stock market remains the best barometer to understand and trust.