The long-expected consolidation has arrived, albeit a little behind schedule. Pundits cite US politics. So far, it’s been a mixed bag of reasons for a deep pullback… geopolitics, Fed jawboning, interest rate prognostications and today, GDP.

My viewpoint, as readers know, is that these periods between quarterly earnings season are when investors tend to take their eyes off the ball.

Early in the earnings season, the banks report and they do little to move the market needle. When the growth stocks report soon after, then we get into the meat of the season and we start to understand what the earnings trend will be. In the next 2 weeks, as a flood of earnings are released, we”ll get a sense of the beat rates. Expect a dramatic increase in volatility as these are digested. Expect quite of bit of setting the bar low and sandbagging.

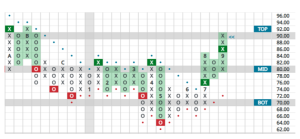

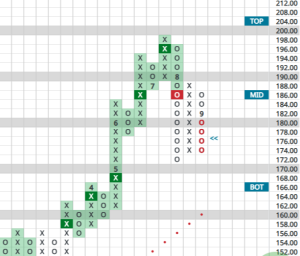

Let’s look at the QQQ’s, the tech and growth stock proxy.

The drawdown form July 2023 to the trough of October 2023 was 10.38%.

So far this draw down has seen a 6.74% decline.

Contrast this action with the price movement in 2022.

2022 was a difficult year for all asset classes and growth stocks took it on the chin. The April to October decline that year was 31.08%. The August to December decline was 21,2%. All the while, sellers fully dried up during the nearly yearlong consolidation.

While markets conditions are very different today from 2022, we have expected shorter and shallower pullbacks in the context of a strong election year uptrend. So far, that is exactly what we have gotten.

The takeaway? Based on the action thus far in 2024, which has already seen a number of important sectors fall toward overbought levels on a Point & Figure basis, investors can once again look to be buyers of this dip, particularly in technology, broadly speaking.

Given the shallowness of the pullbacks thus far and the still-favorable backdrop of it being an election year, expect tech stocks and the QQQ’s to be higher by year-end.