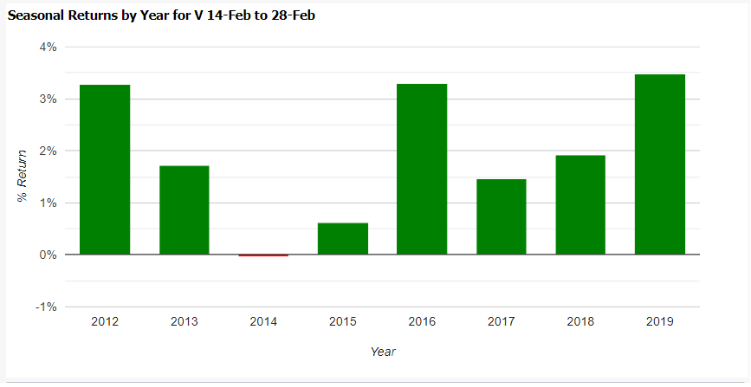

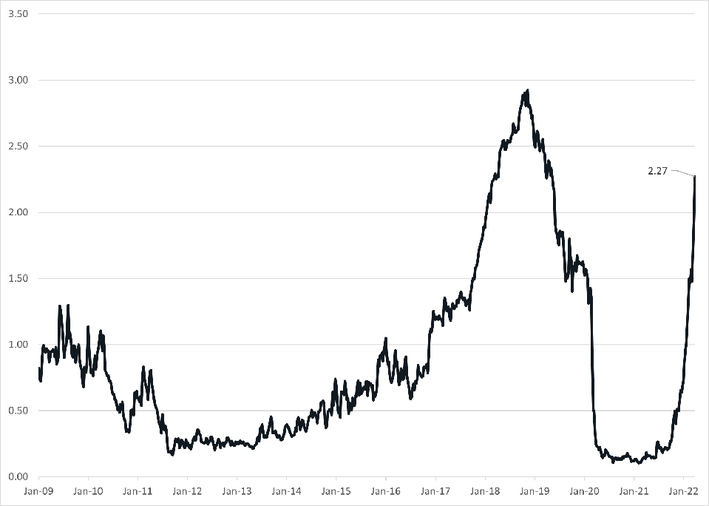

Oil Price Seasonality is in Favor, Trading Action is Not — Yet

We have heard a lot about the market’s seasonality lately, that favorable period from November to April where the investment returns are at their heights…

Oil Price Seasonality is in Favor, Trading Action is Not — Yet Read Post »