Two week ago, I wrote that although the market picture had become a bit mixed, technically, key indicators were suggesting there was certainly no cause for alarm – that the most likely path for stocks was higher, as usual.

Today, an underlying question investors might be pondering is whether they should favor growth stocks going forward, or value?

Over the past 20 years, growth has generally trounced value. Recently, only during the drawdown of 2022 did value present a port in a storm, declining much less in percentage terms than value. This isn’t a surprise, as I wrote about in January.

What I also said at that time was that the baton had been passed, that growth stocks were back in the driver’s seat.

That call has not only played out well in the ensuing months, it remains the case today: it appears investors should still favor growth over value.

One way to draw such a conclusions is via relative strength. Generally, relative strength is used to measure a stock or sector vs. the market more broadly; investors are wise to look for stocks that are exhibiting such strength as they tend to continue outperforming. Further, erosion in such leadership can help identify early when to make shifts out of sectors that had been carrying the load.

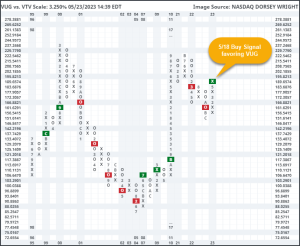

But relative strength doesn’t have to be measured only against the market as a whole. Sometimes it is useful to compare asset classes, sectors vs. sectors or in this case, styles. Below, then, is the relative strength position of growth vs. value today:

In a chart like this, the numbers mean little; this isn’t a security with a price, we’re merely charting the strength of two styles versus one another, in this case via the Vanguard Growth and Value ETFs. Also as a reminder, numbers represent months (and letters represent the double-digit months of Oct-Dec).

Knowing this, it can be seen that my January call that growth had taken the baton could be considered “early” or even a bit speculative if based only on this relative strength reading of the two styles. It wasn’t, however; I had already turned bullish on the market 3 months earlier, which highlights why we watch many indicators in combination — never relying on just one. Indeed, only now, 5 months later, has growth put in a bullish confirmation of this trend by exceeding a prior rising column of X’s. This suggests that while so many voices are fretting the recent surge, we should see ongoing strength in the growth names vs. value

In January, the end of last year’s brutal tax-loss selling allowed beaten down growth stocks to once again take over. Today as we approach mid-year, this one important indicator suggests that trend will be longer-lasting than most think.

What might allow today’s hottest names to continue leading the way? I’ve been thinking a lot about AI lately, and whether today’s trendiest names will be merely a dangerous flash in the pan or will lead to a trend that’s far more lasting. Starting in a few days, I will embark on a multi-part series to try and answer precisely that question from both a fundamental and technical viewpoint.

More soon…